Embedded Structural Contempt for Personal Freedom

I must confess to being a junky for reading economics and investing sites. A person can't beat the market for a long period of time without having some skills, and so the level of discourse you find on top investing blogs blows other areas out of the water. And sometimes the comments are more quote-worthy and insightful than the blog posts. For instance, "The organisation of society is for one purpose only, to separate as much labor-value from the majority as is possible."

Cynical? Or Realistic?

Some people might look at the above quote and say "well that is cynical" but the truth of a debt based money system means that many people MUST fall behind and be impoverished by debt. How else do you explain most people having nothing saved for retirement going into our jobless recovery, while their children get to eat nearly 6 figures of debt just for being born?

It is fraudulent, but it is how "the system" is set up, and until enough people get outraged by it, it will continue:

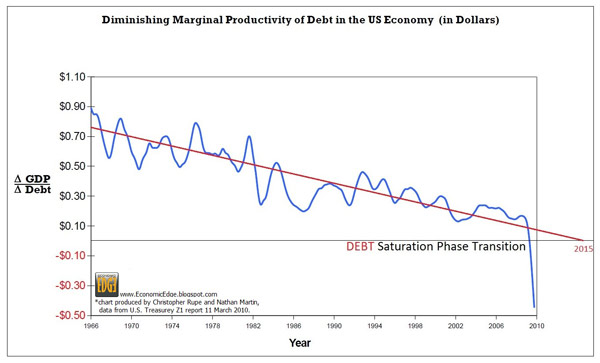

That chart of diminishing returns is the window to understanding why humankind is trapped in a central banker debt backed money box. No money for NASA manned space flight - NASA's total budget a puny $18 billion in comparison to the $1.9 Trillion that went to service the bankers last year. One half the schools closing in Kansas City, states whose debts and budget deficits seem insurmountable all pale in comparison to how much money went to service the use of our own money system.

It doesn't have to be like that, in fact it's a ridiculous notion that the people of the United States, or any country, should pay private individuals for the use of their money system. Ridiculous!

It's difficult to see this from inside the box, so let's look at what happened to Iceland to illustrate. The central banks of the world created financial engineered products and brought them to the banks of Iceland. These products created a boom in the amount of credit. Prices of everything rose, and the people of Iceland then had no choice but to go along for the bubble ride. Then with incomes no longer able to service the bubble debt, the bubble collapsed.

To "save the day," the IMF and central bankers around the world rushed in to "rescue" the people, banks, and government of Iceland. They did this by offering loans... documents that create money simply by signing a contract of debt servitude. That contract demanded ownership of Iceland's infrastructure such as their geothermal electrical generating plants. It also demanded the future productivity of the people of Iceland in that they should work and pay high taxes for decades to pay back this "debt." Debt that they did not create or agree to service in the first place!

There were some wise people who saw through this central banker game and started a movement. They DEMANDED that the President of Iceland put the debt servitude to a vote and the people wisely said, "Central Bankers Pound Sand!"

How Structural Accounting Fraud Produces "Wealth"

All around the world banksters make large bets, and lever up on any kind of fraud they can spread to blow huge speculative bubbles. When/while they win, they keep the profits. When they lose (an inevitable consequence of blowing huge economic bubbles), they threaten to destroy the economy if someone else doesn't cover their losses. The correct term to describe the strategy is financial terrorism.

They Don't Make Presidents Like They Used To!

"I believe that banking institutions are more dangerous to our liberties than standing armies. If the American people ever allow private banks to control the issue of their currency, first by inflation, then by deflation, the banks and corporations that will grow up around [the banks] will deprive the people of all property until their children wake-up homeless on the continent their fathers conquered. The issuing power should be taken from the banks and restored to the people, to whom it properly belongs" - Thomas Jefferson

Some people thought the current US president would be different than the most recent president. It is the populist angle he based his campaign on. But promptly after entering office he got on his knees for the banking class. "And the banks -- hard to believe in a time when we're facing a banking crisis that many of the banks created -- are still the most powerful lobby on Capitol Hill. And they frankly own the place." - Dick Durbin.

Non-transparency = Fraud

The sad reality is we are headed toward bankruptcy and are implementing exactly the wrong strategies if we have any hope to get out of it. Years after the fraudulent bailouts were passed in the U.S. (against the will of the people) the Federal Reserve is still withholding information and appealing legal requests, and key members are willing to commit perjury to maintain secrecy. When they gave away a half-trillion Dollars to foreign interests they couldn't even share who got the money.

The don't worry, trust us angle doesn't hold water when the mathematical realities of failure hit us all. "Nontransparency in government programs is always associated with corruption in other countries, so I don't see why it wouldn't be here" - Gerald O'Driscoll, former vice president at the Federal Reserve Bank of Dallas.

Until the bankers who looted Trillions of Dollars via mortgage fraud see jail time I don't think there is any hope for change. The system is rotten to the core, from the top down.

Moral Hazard in Context

Normally we make laws to prevent such corruption: "In the early years of the London insurance market, it was possible to buy a life insurance policy on a complete stranger. Then insurance companies noticed the high incidence of unexpected homicides among their lives assured, and the concept of insurable interest was devised, codified by the Life Assurance Act of 1774. Today, you can’t buy a life insurance policy unless you can demonstrate some loss by the assured party’s death. The business is safer that way!"

In paying banksters for losing money & relaxing accounting standards (so they can claim false profits while losing money), they are only encouraged to commit more fraud. It's moral hazard writ large.

Stolen vs Earned

Give anyone a trillion Dollars to play the market, backstop the losses on the losing half and let them keep the profits on the winning trades and they will make billions. It's so easy a monkey could do it. And yet it is considered a legitimate trade for bankers to do just that.

Most of these large financial companies are entirely parasitic in their nature, providing society with no real or lasting value - stealing whatever they earn while creating economic distortions that harmfully misallocate capital. Whatever scam they can use to steal your retirement will be deployed: "Quite bluntly, the clueless dolts who allowed [high frequency trading] to occur need to be publicly excoriated, fired from their job as exchange officials, and driven out of town on a rail. Oh, and, all the gains from this organized theft should be clawed back from all the front-running firms that stole this money — THAT’S RIGHT, ITS THEFT — one quarter cent at a time. - Barry Ritholtz"

A top investment bank can give you bogus trading tips on a stock over a half-dozen times in a row - while trading against the (mis)information they share publicly to move the markets. But if someone else trades against that information before they do it is illegal and must be stopped.

How is This Relevant to the Web?

The web shifts the flows of information and finance. The above mention folks in positions of authority don't like that much.

"In a time of universal deceit, telling the truth is a revolutionary act." - George Orwell

Popularity is the inequality in supply and demand, equalized by price. The web allows for a direct connection between content creators and their audiences with little to no intermediation:

This isn’t complicated. In today’s wired world, the most important economic competition is no longer between countries or companies. The most important economic competition is actually between you and your own imagination. Because what your kids imagine, they can now act on farther, faster, cheaper than ever before — as individuals. Today, just about everything is becoming a commodity, except imagination, except the ability to spark new ideas.

The inventor of the web & leaders of other popular internet services think government transparency is important. Many people view access to the WWW as a fundamental human right.

What do elected officials like Jay Rockefeller think? The internet should have never existed.

Numerous governments have aimed at destroying WikiLeaks due to fake security concerns, while some government agencies track social network activity. Lets not forget how many governments are willing to outright lie to their own populous to gain support for bogus wars. War is a racket. It always has been. Just like our banking system!

The freedom and opportunity the web represent can't last long. If it does, many of the above concerns will try to regulate it or (rightfully) find themselves irrelevant.

Where do you place your bets? And who is betting against you?

Comments

Aaron

based on your writeup, I would suggest you check out the www.market-ticker.org, Karl is as passionate about exposing the scams in the present system as anyone I have come across...while I dont always agree with his postings he will never pull punches or straddle the fence with his opinion...

The current generation thinks it is covering new ground but when it comes to money it never is. This debt disaster will end like every other one that has preceded it: economic collapse, a.k.a. depression. People don't want to think about having to live through that horror so they stick their head in the sand.

Political expediency brought us the Federal Reserve, which most don't realize is owned by a handful of banks, such as JP Morgan Chase, Bank of America, which directly contradicts the constitutional mandate of gold and silver coin being our money (your relevant Jefferson quote). Read it, it's in there.

Another great post Aaron. The last post about opening one's books tire kickers was great. You probably read Mish. Google it if you don't, he's on the same economic page.

The population is watching reality TV, the Iceland example is really an exception, the rest of “modern countries” is just filled with crazy sheep. There's no hope.

Reading this stuff always reminds me of my favorite Woody Guthrie song, "Pretty Boy Floyd", in which he belts out this dandy:

"Yes, as through this world I've wandered

I've seen lots of funny men;

Some will rob you with a six-gun,

And some with a fountain pen

And as through your life you travel,

Yes, as through your life you roam,

You won't never see an outlaw

Drive a family from their home."

He penned this song about the predatory financial system in the 1930's...scary how it still rings true today.

Keep on keepin' on, Aaron.

15 years ago I bet the system would be collapsed by now. Somehow they keep propping it back up. Now I believe, in the words of a Mark Knopfler song "The man's too big, the man's too strong" so there is no end in sight, not for my generation any way. What will it take, 80% or 85% average income tax rates before it fails? Maybe it never really fails, capitalism completely vanishes. Everything gets "extended" to us and we all live in a glorious land of servitude. No paychecks and no prices. We never have to worry about how much something costs. We smile in glee, only 18 more months and the government let's me pick out a new 32" TV. Oh boy, I have 2 brands to choose from (I'm still a decision maker). Most of my friends don't get theirs for 3 more years. I'm so happy my last name starts with a B. If I had time to do more community service after my 10 hour work days I could get a 37"...

Great Post!

Our economy = paradox

The systems and processes that ruined our economy are being preserved with our money.

Problems with unethical banking practices, credit cards, mortgages, all which cause bankruptcies and loss of the American dream are written off by the banks as they collect more money from the government to keep up the good work.

Corporations which are too large to fail.

Jobs that are eliminated without consequence ruin the economy.

Wherever there are negatives being done, more negatives will need to follow in order to keep the ball rolling.

The problem is there is literally nothing else negative that can be done other than simply killing people off, but they do that too. Food Inc. , Monsanto corporation, anything related to the food industry is used to regulate and control our need for antibiotics, hence the pharmaceutical companies and their bazillion dollars of "funny money" and "research" to help us find a cure... ya right. They want a cure like they want a hole in the head.

Documentaries like Werner Herzog's "Encounters at the End of the World" has a unique title, being its a film about the south pole, or is it: http://encountersfilm.com/

The fact is that these documentaries are putting the facts in our face, we are tested to the extent we can live ourselves should we ignore them.

We strive to become rich in a system built to destroy us and the future of the earth and the reason we do this is because having enough money will detach us from the segment of the population that's being systematically downsized.

I have one question:

Why are 60 year old lawyers representing us in our government? Why are we allowing 60 year old lawyers to make decisions on our behalf, such as decisions about ow the Internet is allowed to operate?

The current level of deficit spending by the US Govt cannot be maintained much longer. Who do you think is funding this massive US debt? The Chinese among others. At what point will our foreign debtors demand higher interest rates to continue funding this debt which become riskier to the lender?

Like consumers with credit card debt that they cannot pay off or even down, higher rates will be paid to debt holders because no other choice besides default on the debt exists. Somehow it seems unlikely that China and other significant foreign US debt holders will just let the US "declare bankruptcy."

As citizens, we need to regain financial common sense which includes living within ones means (money spent <= money earned) while financially planning for the future. The country can and must benefit from the same financial discipline.

If things don't change, will my grand kids be born into 7 figures of national debt or perhaps something worse?

The worst part about this is that the political left and right are basically on the same side in this issue, but they are played against each other by politicians. Most politicians on both sides want things to stay very much the way they are because both sides receive so much money from the powerful banking lobby, as you said. The truth is that both Dems and Repubs are responsible for this. Republicans pushed for all of the deregulation, but Clinton was prez when much of it happened. Repubs were in power when the bailout occured, but Dems supported it and very few on either side called for strict terms/regulations/transparency as a stipulation for the money.

The left and right are going to have to get over themselves and come together to force our politicians to get money out of our politics because we have seen that whichever party is in power is never willing to do it. All legislative efforts have been/will be tainted until that happens. They may have some disagreements on how to fix things, but I think there is very wide agreement as to what the problems are.

Thanks for this post Aaron, I found it very interesting & learnt through reading it. You continue to add value on many levels through your blog. I think what is being asked from business now & for the next 20 years or so is to start building a foundation of ethics, integrity & moral code into business. Business is what we do in the world and therefore not unrelated to who we are internally. If bankers treated their close family & friends the way they treat customers then all the money in the world would not make them happy. We are all in this boat together, we are all affected by each other's actions whether that is immediately obvious or not. Its time for the leaders of the business world to get a foundation of integrity or let go their roles because in truth they are not leaders if there is no integrity. I just posted an article 'Ethics for Entrepreneurs' http://www.ezebis.com/venture/ethics-for-entrepreneurs/2010/03/ A foundation of ethics in business would change the game, it would be more win-win.

Also, check out http://www.iousathemovie.com/ for a half hour, non-partisan video summary of America's current debt situation.

Funny: I'm taking a class on corporate voting and a lot of what we talk about is the manipulation and elimination of risk by Hedge Funds and other Big Finance (Brother?) players who throw money around quickly seeking arbitrage opportunities.

Have you ever heard of empty voting, vote buying (no, not link buying ;)), or short selling? Different ways you can basically vote shares in a company without 'owning' their economic benefit/loss. Which means you can bet the stock will tank, buy a huge chunk of it, sell the economic upside/downside [so you're just left w/ voting rights] and vote for the company to screw up badly so your bet pays off. And there's so little transparency that people don't know to what degree this goes on (in fairness, my prof says it's not a frequent occurence.)

Moral hazard - fun idea to play with (if you have $B in market cap or an active imagination :D).

Why are we debt financing our government in the first place?

Good quote on what our fraudulent system of economics leads to as most in the world fight for the crumbs that fall off the financer's table

Kurt Vonnegut Jr.'s poem Requiem: ‘When the last living thing, has died on account of us, how poetical it would be if Earth could say, in a voice floating up, perhaps from the floor of the Grand Canyon, “It is done. People did not like it here”.’

(Nothing to do with SEO, but I hope I have posted it in the right post)

Hi Aaron,

I have some money invested in the stock market. However the markets are tanking due to the debt crises of the US government. So I did some studying.

Source: http://www.rediff.com/business/slide-show/slide-show-1-special-sensex-is...

This makes me Slightly worried!!!

How long will this continue? My concern is this if this is going to last very long (looks like it will). When do we get out of this panic situation? Should we invest in other instruments like Gold, bonds etc.?

Very eager to read your views.

and that is what somebody wanted...

The questions are: who? why?

If you value your savings enough to want to protect it then I recommend a paid subscription at iTulip. Eric Janszen answers those questions...rather clearly.

And if you are too cheap to do that (even after reading the recommendation) then you deserve what is about to happen!

Add new comment