Update

Another Option

Based on the negative remarks directed at Wordstream in comments on this review (about aggressive "flexible" sales techniques, long-term client contracts, etc.) & a discussion with one of our friends who manages a number of large AdWords accounts, we recommend Optimyzr, as Timmcg did below.

Modified Broad Match for the Win

Since Google added modified broad match ad targeting to AdWords, it is typically a far more efficient use of a business owner's time to manage the longtail of search with modified broad match and negative keyword targeting rather than managing thousands and thousands of low traffic terms. Using modified broad match and the desktop Google AdWords Editor makes many "optimization" features in some DIY PPC platforms obsolete. And I write this as a person who offers one of the more widely used free keyword list generators.

Finding secret uncovered keywords that no other ads are showing against? That ship has largely sailed. Really broadly matched targeting on broad match keywords guarantees most terms with significant value will have multiple bidders aggressively competing in the ad auction, with Google both carrying ads across from other related keywords and lifting floor ad prices based on the performance of related keywords.

An Example of Using Modified Broad Match

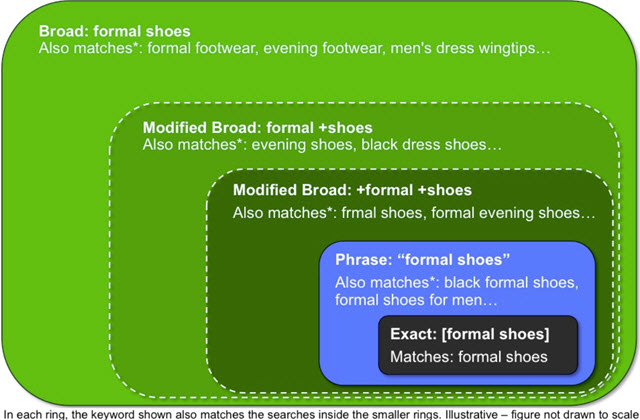

Here is an image Google shared when they first publicly unveiled modified broad match.

The beauty of modified broad match is it allows you to capture a vast array of longtail terms using just a handful of keywords. For example, if one wanted to cover longtail concepts around "keyword tools" or such one could add something like this:

- +keyword +tool

- +keyword +tools

- +keyword +research

- +keyword +programs

- +keyword +software

The above would target thousands of different unique keyword tool related searches (like: downloadable keyword research tools, online keyword software, etc.) without requiring a person to manage thousands of independent terms. And then let's say a particular term tends to have little to no value to your business. For example, let's say people wanting "free" rarely convert to paying clients. You could then add that term as a negative match -free to block your ads from running against searches containing that term, or you could add it as a negative match to that campaign and then set up a second campaign with lower bids that doesn't block those sorts of modifiers. In such a way you could quickly capture most the cream from the longtail while blocking out the worst bits of it (or bidding significantly less for the lowest value portions), while having minimal management overhead.

So Why do People Still Pitch Huge Keyword Lists?

Some parts of search largely run without direct keyword control anymore. And those that you can easily control are far more efficient to control with tight targeting on the head and the above broad match strategy on the tail.

That leads one to ask Why were huge lists of keywords ever popular?

The Original Reason

Overture was a pioneer in paid search. Google was highly inspired by Overture when they created AdWords. In fact, Google had to give Yahoo! a bunch of their shares before the Google IPO to settle a lawsuit for violating Overture's paid search patents. Google ended up winning search by both owning distribution (while Overture relied on syndication partners) and having a more efficient ad auction. One of the reasons the Overture / Yahoo! Search Marketing ad auction was less efficient is they would put a far lower priced bid first if someone bid on a specific term and a competitor bid higher for a broad matched term.

For example, if your competitor bid $50 for web hosting and you bid 10 cents for shared asp web hosting and nobody else bid on that term, your 10 cent ad could show before the competitor's $50 ad.

This inefficiency in the Overture ad auction is part of what drove the demand for creating large lists of keywords. It is also a big part of why Yahoo! struggled to compete against Google in search. By the time this problem was fixed, Yahoo! was aleady well on their way to outsourcing their search & search ads to Microsoft.

The Current Reason People Still Promote Huge Lists of Keywords

The reason large lists of keywords which get next to no traffic remain a popular "marketing" approach (in spite of modified broad match existing) is those lists are quick to generate and they allow some people to show they are doing "lots of work" to justify management fees, even if that work is of marginal efficacy.

Below is our original un-revised Wordstream review from over a half-decade ago, back right around when modified broad match first launched, but before it was widely used.

Wordstream Review

Wordstream is a suite of online marketing tools which cover Keyword Research and Management for PPC and SEO Campaigns. They also offer a Firefox plug-in which we'll cover in a bit. Wordstream gives you access to three free tools:

- Free Keyword Niche Finder

- Free Keyword Suggestion Tool

- Free Keyword Grouper

While there are many free and paid keyword tools on the market Wordstream does offer more in the way of integration with industry leading products like Google AdWords and Google Analytics. Recently Wordstream earned the Editor's Pick award in the Google Analytics Application Gallery:

Google Marketplace Award

Wordstream's keyword data is produced via "blended" data which they acquire from multiple sources. The discuss their data sources on the FAQ section of the Free Keyword Tool. It's important to note that they do not simply pull keyword data from Google like many other "keyword research" tools do.

Both PPC and SEO campaigns can fall victim to poor organization which leads to poor site or campaign architecture which eventually leads to poor results as data becomes more and more difficult to accurately manage. Wordstream aims to aid in your keyword research, PPC campaign management, and SEO execution.

Free Tools

Free Keyword Niche Finder

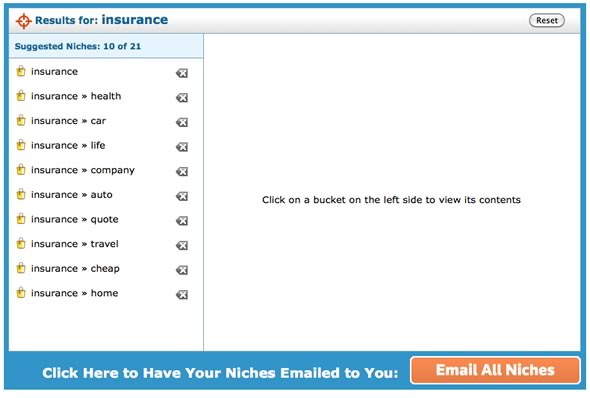

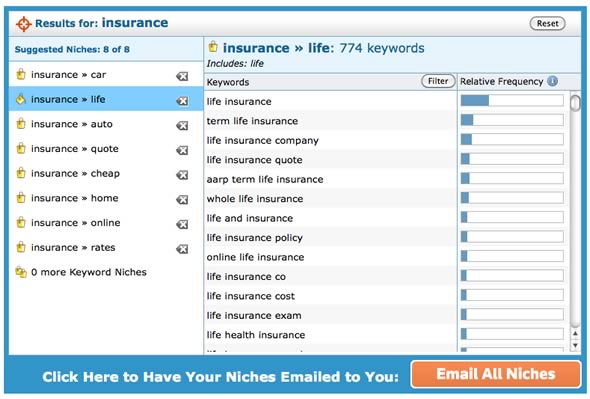

The Keyword Niche Finder attempts to find niches of a core keyword. In this example I chose insurance. Usually, I've had better results with this tool by using really broad keywords. The longer you get into the tail the less associations the tool can perform hence the less niches available for you to analyze.

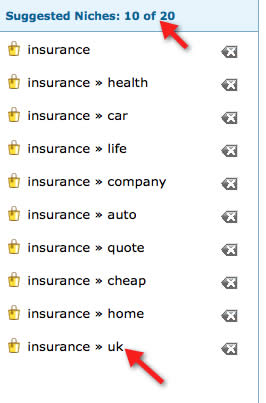

You can choose to have the niches emailed to you (you'll get a zip file of all the niches shown on the screen, not all the available ones so be sure you've got the ones you want, and they come as separate .csv's within the .zip) and you can get started sorting through the niches shown to get an idea of what part of the insurance market you may want to pursue. Let's say I'm not interested in travel insurance. So I click the X to get rid of that and another niche pops up, "uk" insurance. Note the number of niches has gone down and I'm left with a new niche to evaluate, "UK", within the insurance market.

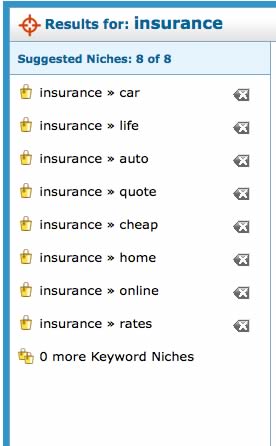

So after sorting through the available niches I've narrowed it down to the following niches:

So I've decided to pursue the life insurance market so I click on the bucket and I'm shown 774 keywords for that niche. As you can see, there is a filtering option but that is available to paid subscribers. Relative frequency refers to their "blended data" approach meaning the term life insurance quote typically is searched more often than life insurance exam in aggregate.

If this is the only niche you want to target simply remove the other niches and request the emailed .csv (need to leave at least 2 active niches for export though). This way you'll receive the keywords you want for further processing in whatever spreadsheet application you use. This tool is somewhat limited as it is a free tool but it can be a pretty useful way to get a broad view of niches available in a specific market when first starting out.

Plus, it's a pretty slick way to bounce back and forth between different niches without having to re-query a keyword tool every time you want to look at a different market.

Free Keyword Grouper

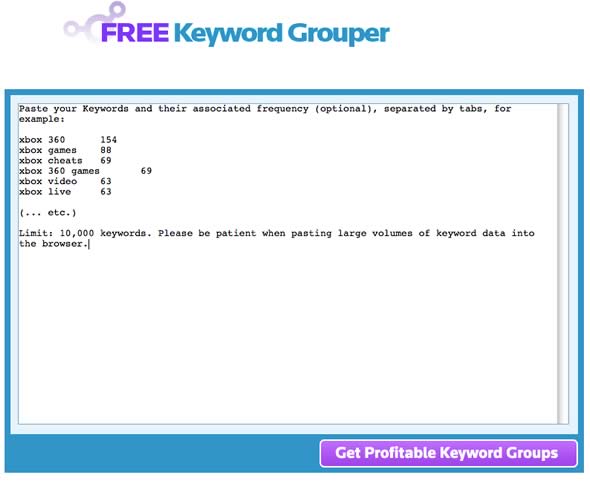

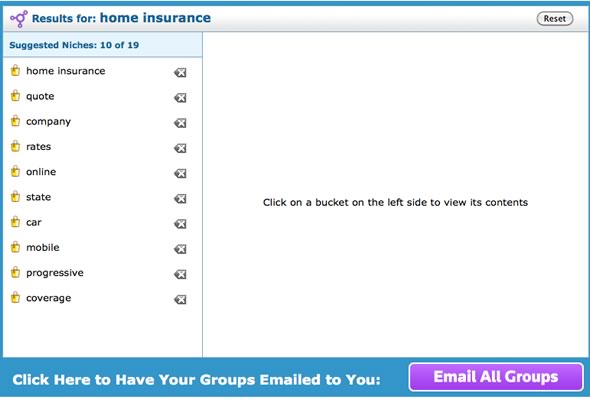

Wordstream's Keyword Grouper tool where you can enter up to 10,000 keywords and have Wordstream group them by category and word/modifier association.

This tool can be quite useful when you pull data from something like your web analytics or PPC programs and receive a variety of new keywords back. The Keyword Grouper tool will group using modifiers (cheap, free, buy, etc) which helps you identify new market segments or new keywords you may have been missing out on initially.

I think the idea behind the tool is solid but I also think you'd want to spend some time going through your own results to further refine your data. The following screen shot was produced after entering the following data:

- home insurance 88

- auto insurance 39

- home insurance company 33

- auto insurance quote 28

The groupings are mostly sensible and they also filtered in some modifiers that I didn't originally include but ones that I know are valuable in this industry. Aligning your keywords to your site's structure is always a good idea when doing SEO and this tool can help a bit in that area. The tool (free) is not perfect but it does provide useful, actionable data.

Wordstream put out a helpful Keyword Grouping white paper as well.

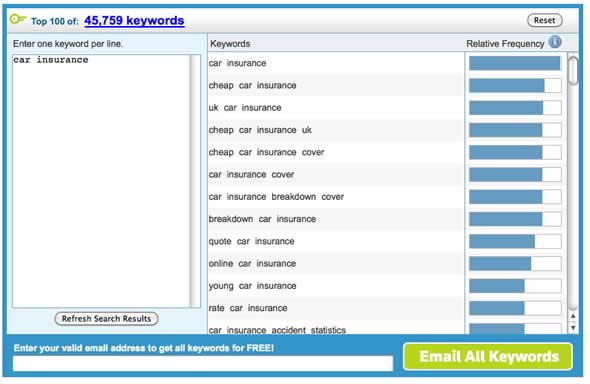

Free Keyword Tool

Wordstream's Free Keyword Tool does exactly what you would expect it to, it gives you keyword data. Their "blended" method of aggregating data can be found here.

My Favorite Feature

When you export the keywords you are given the top 10,000 sorted from the highest relative frequency to the lowest! Car insurance returned over 45k results and I am now able, for free, to download the top 10k keywords in order of search volume. This is a killer feature for any keyword tool, much less a free one. Consider that:

- Wordtracker goes up to 1k

- Google AdWords is less than Wordtracker

- Even some Competitive Research Tools do not offer the ability to export 10k results with sorting enabled!

So that about sums it up for their free tools. I personally like how Wordstream keeps feature bloat out of these tools. So many times you see these keyword tools come out and start making up their own custom metrics which at some point involve:

- Total number of competing pages

- Some form of KEI

- Some made up metric to distract you from the fact that all they are doing is pulling data from Google and recycling it :-(

A keyword tool, which pulls data from sources other than Google, has some inherent value as we know that Google's data often has disagreements within their own tools so it's important to have one or three third party sources of data.

Paid Tools

Wordstream's toolset is broken down into 4 groups of tools:

- Discover Keywords

- Manage Keywords

- Create PPC Campaigns

- Create SEO Content

Discover Keywords

Keyword Suggestion Tool

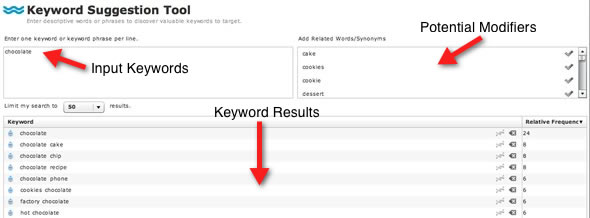

A simple keyword tool where you enter your desired keywords and get up to 10,000 results for your search. Wordstream also provides an area where they suggest related words and synonyms which you can easily add to your keyword search by clicking the check mark adjacent to the modifier.

The keyword results section offers up your selected results with the following options pertaining to how deep your results will go:

- 15

- 50

- 100

- 200

- 500

- 1,000

- 5,000

- 10,000

From here you can whittle down to the keywords you want to add to your campaign (you can add these keywords to your Wordstream database from inside the tool).

The speed and depth at which these keywords are returned at are both very impressive compared to other keyword tools.

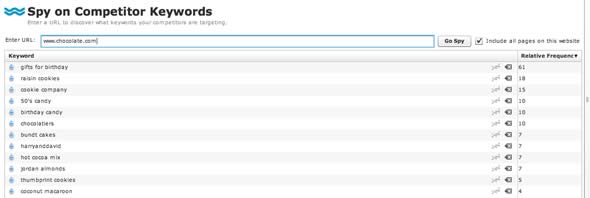

Spy on the Competition Tool

Similar to how the Google AdWords Keyword Tool operates, you can place a URL + check all the pages on a website or just a specific page in the search bar and get keywords relevant to whatever site/page you searched on.

Where I think this tool falls short is in the categorization data that the AdWords tool returns when you place a URL in their search box. The AdWords tool basically gives you a nice head start into potential site structure options via how they break down the categories and keywords within a URL that you search on. You can use Wordstream's organization capabilities after you are done adding the keywords into your database but I think having the initial breakdown that AdWords provides is slick and something Wordstream may want to consider as they continue to develop their toolset.

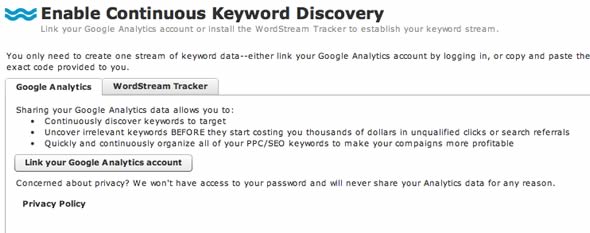

Enable Continuous Keyword Discovery

In a world filled with buzzwords used simply to sell you on recycled products or feature bloat you may look at this as say "riiiiiight". However, this is actually a unique point of differentiation between Wordstream and every other keyword tool on the market.

This tool gives your Wordstream keyword database real time access into keywords that are bringing you traffic from either your Google Analytics account or, if you don't use Google Analytics, a custom Wordstream tracking code you can embed on your website.

If you make the decision to utilize Wordstream to manage your keyword database then this is a killer feature. No other keyword tool offers such a feature, that I'm aware of anyway. So if you are not overly interested in combing through your analytics reports frequently in order to find additional keywords to target, then this feature will be beneficial to you as the new keywords automatically pop up into your Wordstream database.

It's also useful for transitioning these keywords into a PPC campaign you may be managing in Wordstream either as a new keyword to bid on *or* as a negative keyword. So this tool is also handy for being a negative keyword finder as well.

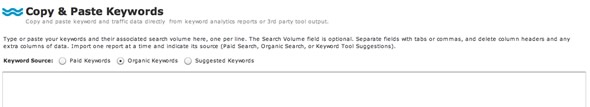

Other Ways to Import Keywords

Wordstream allows you to copy and paste keywords into your account and initially tag them as either "Paid", "Organic", or "Suggested" keyword sources.

You can also download a tool which analyzes your web server logs for keywords

You can also upload a CSV or TSV file...

So those are the ways you can initially find and upload keywords with Wordstream. The second function of Wordstream's workflow is actually managing those keywords.

Manage Keywords

Wordstream puts out three options for keyword management:

- Organize Keywords

- Find Negatives

- Prioritize Workflow

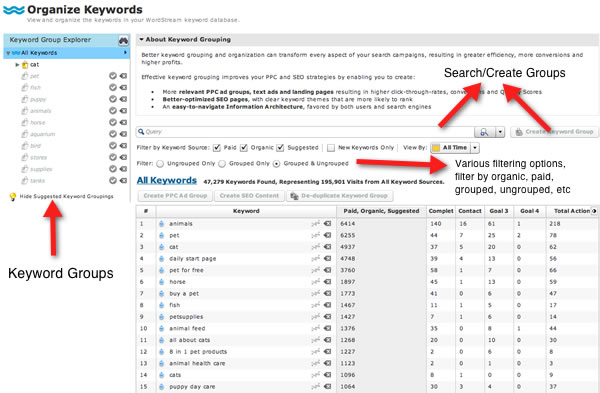

Organize Keywords

At first glance it seems a bit overwhelming, but it's not. You have the following features/options available to you:

- Automated keyword grouping suggestions on the left side, which you can accept, show, hide, or decline

- Keywords in your campaign sorted by paid, organic, or suggested (based on tagging you control), new keywords found via your analytics or AdWords tie in, date filtering options, view by keywords that are grouped and ones that are not grouped.

- The ability to add buckets of filtered keywords to a PPC campaign

- The ability to use their new SEO Content feature to tie into your CMS and create content for a specific keyword

- Goals and Action data, available for customization within your settings options

- Export keywords

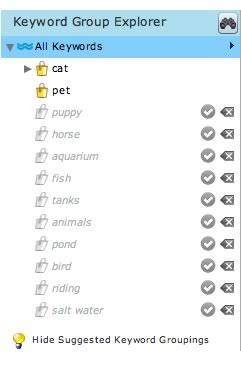

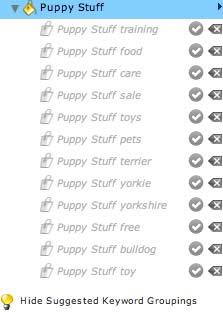

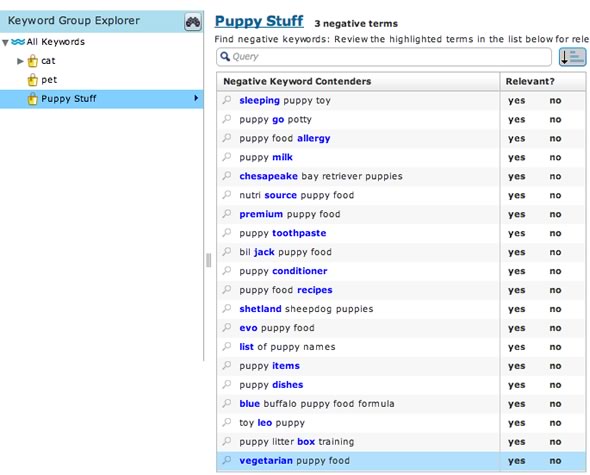

Keyword Group Explorer

The Keyword Group Explorer gives you keyword grouping suggestions based on your keywords. The buckets in yellow are ones which have been accepted by the user as groups and the ones in gray have not been. You can decline the grouping by clicking the gray X or accept it by clicking the check mark. You can hide these suggestions by clicking the light bulb in the bottom of the sidebar.

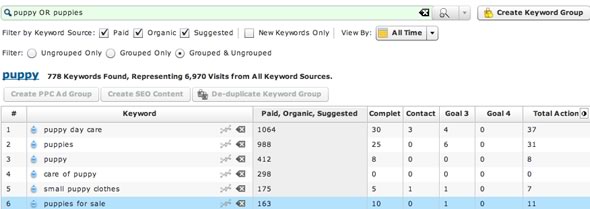

So I'll investigate the puppy suggestion. I click on the suggestions and I'm shown keywords specific to puppy or puppies.

This groups all the keywords containing puppy or puppies into one bucket. You can rename the group by clicking "create keyword group" in the right corner. You can also hover over any individual word in the keyword group to delete it and filter out any other keywords containing that modifier.

I renamed the group "Puppy Stuff" just to illustrate the ability to customize your groups. So back to the Keyword Group Explorer, turned off other suggestions for now and ta-da, there is Puppy Stuff.

The little arrow indicates the sub-groups Wordstream automatically created with the keywords in the Puppy Stuff bucket (I named this pretty horribly as you'll see in a second). So if you click on the arrow you'll see the sub-groups Wordstream automatically created (I should have left it as Puppy!):

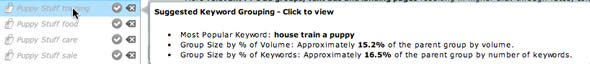

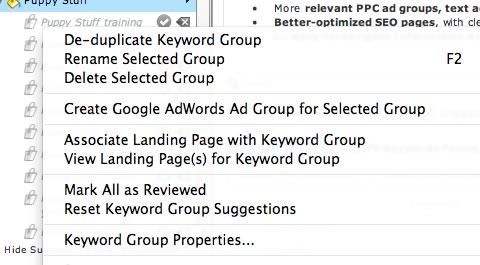

Similar to the main groupings you can click on the check to accept, the X to decline, or the keyword to see the keywords within that group for further grouping and refinement. Hover over a group and see the following:

This gives you the top keyword in that sub-group. The stats are as follows:

- 15.2% represents how much traffic this group could produce, saying the keywords within the puppy stuff training group accounts for 15.2% of the traffic for the main group Puppy Stuff.

- 16.5% represents the % of keywords in this group accounting for that same percentage in the parent group Puppy Stuff. So this group has 16.5% of the keywords in the entire group.

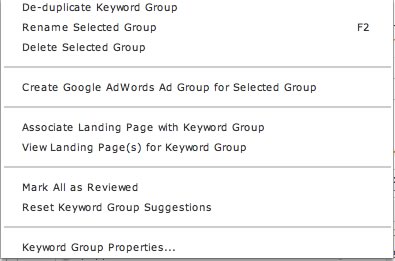

If you right click on a group you get the following options (applies to groups and sub-groups as well)

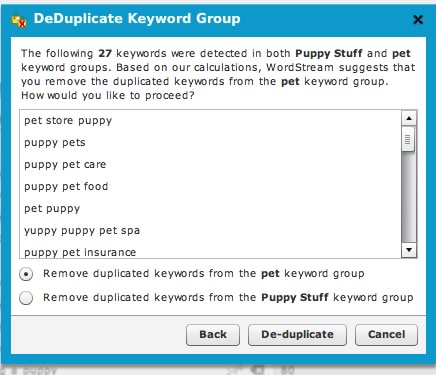

Some of these items are self-explanatory but the de-duplicate option is pretty sweet. Click on that and you'll see duplicate keywords across your groups. This is handy because it really lets you refine your lists pretty quickly and efficiently. You can choose which group to remove duplicates from:

Another neat feature is if you click on the jack looking icon in the keyword results you can get options to search Google Trends, the Google Search Results, Bing's xRank, and Bing's search results:

You can use this method to keep creating more and more sub-groups if desired but usually 1-2 levels deep is good enough. You don't want to integrate so tightly that someone has to click 17 times to get to an article that could have been easily served on a sub-page within a top-level category.

Negative Keyword Selection

This tool allows you to search for negative keywords at the group and sub-group levels. It highlights the words that might be irrelevant to your campaign and gives you the option to accept the modifier or deny the modifier via a yes/no option. So what you are saying yes/no to is the highlighted word, not the phrase itself.

They also have a checkbox option which keeps potential negative keywords out of this report IF they have previously resulted in conversions (via your AdWords/analytics tie-in data).

Once you add a negative keyword in there you can choose phrase, broad, or exact match as negative keyword options. You can manually add negative keywords as well.

One option I'd like to see is "add full keyword/phrase or just highlighted modifier" rather than just adding the modifier.

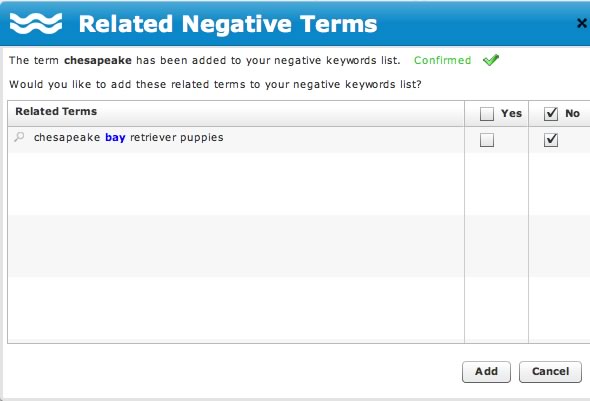

They also offer a feature which tries to associate a selected negative keyword with other ones that appear in this report. So for instance, I checked off Chesapeake and hit yes, then I was presented with this:

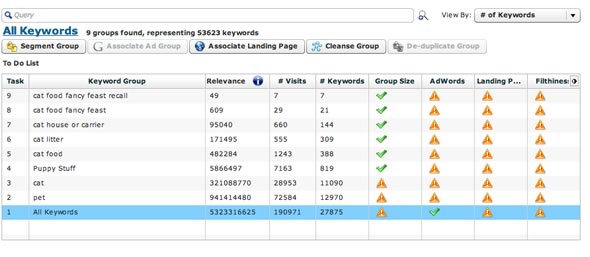

Prioritize Workflow

Wordstream's products play to agency type accounts and workflow is a big part of what they offer. The Prioritize Workflow tool allows you to review workflow information at the group, sub-group, and account level.

From here you can:

- Segment groups with no sub-groups into sub-groups

- Associate an ad group with a keyword group

- Associate a landing page with a keyword group or groups

- Cleanse a group (takes you to the negative keyword tool)

- De-duplicate groups

The columns are as follows:

- Relevance - A custom score which is derived initially from the amount of keywords within a group and how many visits they have driven. Typically the higher the relevance the more important the group to your traffic levels.

- Visits - Total number of visits per group of keywords

- Keywords - Total number of keywords within a group

- Group Size - If you get the triangle it means you've exceed the group size you set (or was set by default) in the Wordstream Settings panel which is found under the Settings Tab - Wordstream Settings

- AdWords/Landing Pages - Shows whether or not a group is associated with a landing page or an AdWords account

- Filthiness - Shows (based on settings that can be modified in Settings - Wordstream Settings) if you've exceed limits set for negative keyword candidates as a percentage of the keyword group.

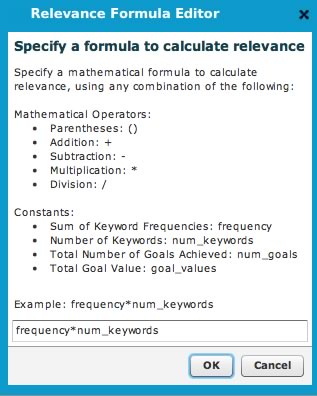

The Relevance field has some customization options:

So you can play with this a bit and throw in goals and value of goals as variables as to show which groups are not only driving the most traffic, but are also producing the most goals. Usually you'll find custom keyword performance metrics are not so great because they don't use any relevant data. Here though, Wordstream is using 3 of the most relevant pieces of data when it comes to keywords and keyword importance

- Actual Traffic

- Actual Conversions

- Value of Conversions

That was an overview of what Wordstream can do for finding and managing your keywords both on the paid search and organic search side. The third piece of Wordstream's suite of tools is the PPC Campaign Management option.

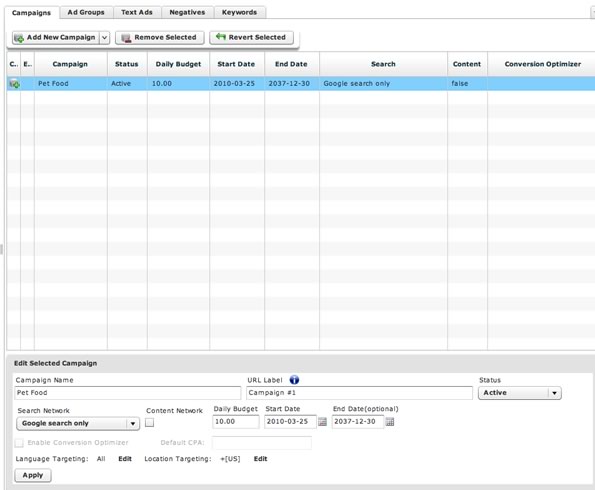

PPC Campaign Management

Wordstream's Create PPC Campaign tab takes you right into a nice, clean (dare I say Google like) interface. Here you can pretty much do everything you can do with the AdWords Editor.

You can do all of the following here:

- Download an existing campaign

- Create a new campaign (for uploading or exporting later)

- Set your campaign name

- Set your campaign budget

- Adjust your campaign status

- Choose Search and/or Content Network

- Work with Content Network bids

- Set a start and end date

- Work with language and location targeting

- Assign ad groups to campaigns

- Interface with Google's Conversion Optimizer

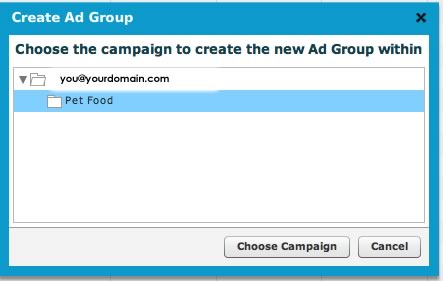

Moving Keyword Groups to Ad Groups

It is very easy to move one of your existing Wordstream Keyword Groups into Ad Groups. All you need to do is go to Manage Keywords - Organize Keywords right click on the ad group (we'll go with Puppy Stuff) and select "Create Google AdWords Ad Group"

Then you are brought to a screen where you select the campaign you want to add it to:

Then the group is added to the Create PPC Campaign interface where you can work with just about everything you are use to working with within AdWords.

Currently you can only work directly with the AdWords interface but you can export your campaigns in both Yahoo and Microsoft AdCenter format.

Landing Page Assignment

In the same way you export Keyword Groups to AdWords AdGroups you can associate landing pages by simply clicking "Associate Landing Page with Keyword Group" in the Manage My Keywords - Organize Keywords area or in the Prioritize Workflow Area.

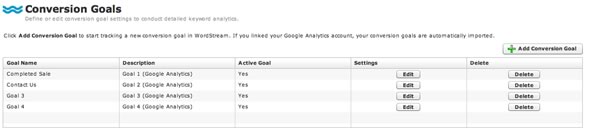

Adding Conversion Goals

If you tie into Google Analytics this is already added automatically added (each time you add a Goal to analytics).

You can manage them here and add ones manually. This is managed in the Settings - Conversion Goals tab.

So this feature is pretty sweet on the SEO side of the house because with that custom Relevancy data we discussed earlier you can get a real, honest picture of which set of keywords are performing well and perhaps where more sub-groups of that keyword need to be investigated for more content and hopefully more conversions.

The goals can be viewed right in the Organize Keywords area and keywords can be sorted by completed goals which is handy when you are refining your campaign.

So this is really another piece of their unique feature which we talked about earlier, Continuous Keyword Research. If you choose to manage your campaign within Wordstream it is really a slick set up for SEO (and PPC) and they are looking to beef up the SEO side of things in the near future which is exciting.

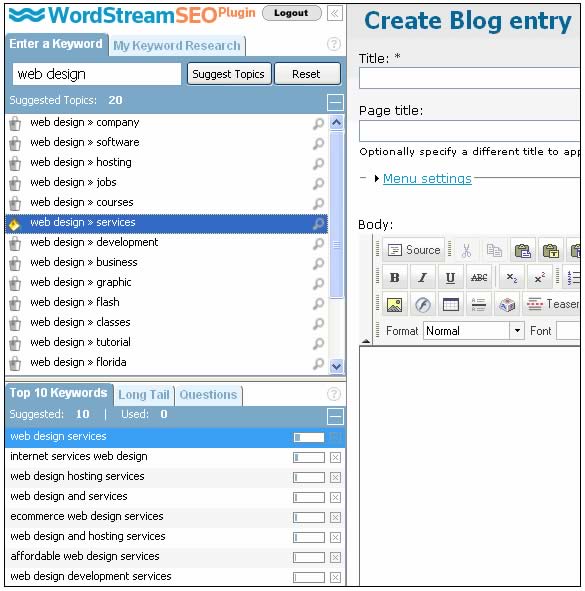

Create SEO Content and Wordstream Firefox Plug in

Wordstream's Create SEO Content feature within your account is a tie in with the Firefox Plug-in. The plug-in is really useful if you utilize blog software for web publishing and especially if you have multiple content authors.

The firefox plug-in loads in the left side of your browser and ties into your existing Wordstream database giving you the option to do keyword research as well as create blog entries right from the plug-in in either:

- Wordpress

- Blogger

- Drupal

- Typepad

If you are self-hosting the blogs/sites on WP, Drupal, or Typepad you'll have to provide your login URL and the URL for adding content. You can use your own CMS as well, but you'll need to manually log in to these CMS's/Blogs.

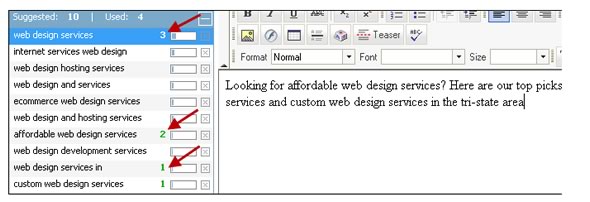

The image below shows you how the keywords are presented (in groups similar to the Wordstream tool), the content tie-in to the right, and the keyword options on the bottom:

- Top Ten Keywords

- Longer Tail Variations

- Questions associated with your selected bucket

And when you are writing your content the tool will show you instances of the longer tail keywords in your copy as you write it!

In the first image the second tab shows "My Keywords". This is the tie in to the existing Wordstream database (your private database) and allows you to start building out your site structure, pretty cool stuff. The "associate content" link indicates that you have not associated a page with your keyword(s).

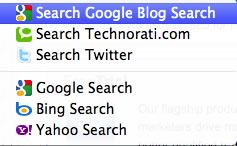

You can also right click on any keyword and get direct access to the following queries:

I stole these images from Wordstream's great piece on their plug-in as they do a great job of showing the CMS integration:

Wordstream's Firefox Plug-in

A Handy Dashboard Ties it Together

In your account you have access to a dashboard that shows the following stats in one spot:

- Top New Search Queries (from Analytics)

- My Search Query Database Size

- New Negative Keyword Possibilites

- Best Performing Search Queries

- Search Query Conversions

- Possible Grouping Options Based on Queries

- Worst Performing Queries

- Best Performing Groups

Great Wordstream resources can be found here:

About Wordstream

Wordstream User Guide

So What Do You Think?

Wordstream certainly has lots and lots of features as well as some nice features not present in any other quality keyword tool (that I'm aware of) such as:

- Continuous research (being able to bounce from keyword set to keyword set right in the same interface and managing those keywords as well)

- Being able to research keywords in clusters/groups with a click of the mouse, then automatically showing sub-categories

- Their database, likely because it pulls from many sources, does a solid job with long tail keywords

- Using your analytics and AdWords reports to automatically pull in new keywords for you to act on, to track goals on, and so forth is a fantastic feature as we discussed earlier (being able to truly see the more valuable keyword sets within your site's architecture)

Overall Wordstream has a robust PPC offering along with a strong SEO toolset offering. In discussing their future plans on the SEO side they did state that they are continuing to improve their UI (which I quite like) as well as continue to add SEO features and tools to their current offering. Their current SEO offering is on par, price wise, with many of the other non-Google tools out there, and offers just as many features as some and more features than others.

They have a 7 day free trial available and I think it's worth spending some time with their toolset to see if it fits in with your current workflow. You can manage multiple sites (profiles) so long as you own and operate the sites. You can also get an agency account with Wordstream so you can manage client accounts as well. Each type lets you add multiple users to the account to assist with whatever your workflow needs happen to be.

Check Out Wordstream

Wordstream Pricing Options