A Few Warnings When Selling Online Business Websites

When Transparency is Valuable

If you are selling a site which you just want to get rid of and lack passion for then there is nothing wrong with being fairly transparent and shopping it for the maximum amount you can get at an auction or such. And if you have high growth and contact an investment banker to get a bidding war going then limited transparency can help then. But if you have a high growth site in a high growth field and there is only one company trying to buy your site then transparency is the opposite of leverage. It can only work against you.

Scam Website Purchase Offers: How They Work

Over the last couple days a company made a pretty fair offer for one of our websites. He did so knowing that I wasn't going to give up our analytics data UNTIL the cash was in my bank account, and that he could infer a lot of the data from the search results. This was like the 5th time they tried buying the website and these points were made to them on every attempt.

The guy said "if that sounds good to you I will get a Letter of Intent over to you." I said sure, and in return they were like "ok now we need access to all your stats for our due diligence document to fill out the LOI."

And that is a big pain point / problem.

WHY?

Data is Valuable

Data is valuable. Anyone who has the money to buy one of your best websites and has people scouring the web trying to make such deals probably has other sites in the same vertical. It is a near certainty. If you give all your data to someone *in an attempt to sell* what you may end up with is a weaker site and no buyer.

And if you know they already have other sites in the same space, well then you just shorted your own company's stock in exchange for nothing but a clown outfit.

Why buy the cow when you can get the milk for free?

The people who ask you to give up all your business data, and want exclusivity on a deal while they mull it over and debate it and re-price it, while pillaging your analytics data are actually telling you "we think you are an ignorant jackass and lack respect for you."

The sequence goes like: hello how about I buy that from you for $xx. Sound good? Here now give me all your data and I will give you a shady low ball offer of $y and then go buy a similar site from a more ignorant seller. We only buy at far below market rates! Don't worry. We *WILL* use your data against you!

If they make and offer they make an offer. If they want to steal you data they want to steal you data. But if they already make an offer based on their observations there is no need to grab all the data to reposition the offer - in short it is a scam.

Business Reciprocity 101

A slimy business person doesn't trust other people because they think everyone else is just as slimy as they are. So here is the test to use on such offers: tell them "sure you can have all my analytics data right after you give me all of their analytics data." If they say you are being unreasonable then tell them to look in the mirror.

We have made quick page title change suggestions on a client website that have literally immediately brought in millions of Dollars for their business (and as consultants we only got crumbs for the value add), BUT if you have a competitor who is considering buying your site they can look for the areas where you are strong that they missed and simply clone them. If their domain is far more authoritative they just took a chunk of your traffic. And you gave it to them - free of charge.

We have had competitors clone some of our strategy in some areas, but on numerous occasions they have picked the wrong keyword variations or the wrong modifiers. If you just give them the data for free there is no guesswork. They WILL use their capital to steamroll over you.

Why NDA Contracts Are Garbage

Sure some such companies claim to be professional and that their NDA has some value. But does it? Do you actually have the capital sitting around to do a legal battle with a billion Dollar company with more in-house lawyers than you have total staff? What kind of ROI would such litigation earn IF you won it? What are the odds of you winning? Can you actually prove how the used your data? How much time, effort, and stress would go into such a battle?

Why Do People Purchase Websites?

If people are coming you to buy your site they are coming to you for a reason. There is some strategic value, or some level of synergy to where they feel they can add value to your position. As an example, a big company like Yahoo! or eBay or Amazon.com or Google or BankRate or Monster.com or WebMD could...

- use a purchase as a public relations opportunity to make the purchased website stronger

- integrate it into their network to own more of the market and have better control over pricing

- cross promote it on their network

- cross promote other options in their network to that site's audience

- use it as a wedge to influence markets in way they don't want connected with their core brand

- expand their market breadth without diluting their brand

- etc etc etc

The point being very few people buy a business based on thinking they can/will keep it exactly the same. Rarely do you buy a raw domain name based on its earnings...you buy it based on the potential for what you can develop on it, and the growth + opportunity you see in that market.

Is there risk in the growth? Absolutely. What successful investor hasn't lost money? But that risk is discounted in the price of the site...after all, the future market growth and site growth are not passed onto the seller after the site has already been sold.

Have I lost money on some website purchases? Absolutely, but on average we have come out ahead. You don't need perfect data to make a purchase so long as you have some good ideas on how to add value. You can have a few duds and come out ok so long as you have some winners and ride the winners hard.

What Data Discounts: It is Backwards Looking

Any attempt to get the exact earnings AND all the keyword data for a website for free is simply exploitative. It gives the buyer leverage while placing the seller in a vulnerable situation. It moves the purchase away from strategic value to some b/s multiples of earnings which rarely accounts for *why* the purchase is being made.

Is it a defensive purchase? Is it a purchase where there is an instant synergy and strategic value add? Do they have more data than you and do they see strong market growth in the near future?

Strategic purchases like YouTube don't sell for over a Billion dollars based on a backward multiple of earnings. When companies buy important websites they don't insult the owner with a 1, 2, 3, 4, or 5 year multiple. The S&P 500 has historically traded around a 15 or 16 multiple, so even a 6, 7, 8, 9, or 10 year multiple is not great if you have some strong strategies to increase organic search traffic, build new revenue streams, and improve conversion rates.

If a company trading at a 30x P/E multiple offers to buy your site for an 6x multiple, then they get a higher revenue cut due to their market position suddenly they have purchased your website for something like a 3x multiple... about 1/10th of what the market is valuing their enterprise at.

If they hold back some of the payout for a year then they are paying for a portion of the site out of future earnings, and the real multiple being paid is even less - maybe only 2!!!!

This quote from maximillianos at WMW explains why the give us all your data and we will give you some crappy multiple approach sucks for the prospective seller:

I opted to keep the site and put it on auto-pilot. That was about 9 years ago. Today the site makes more money in a month than what I almost sold it for back then. So maybe the sale falling through is not a bad thing.

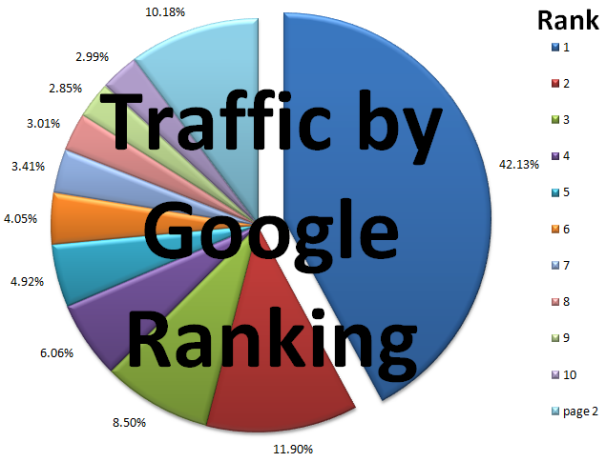

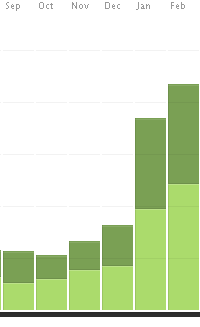

In the search game increasing your rank by a few positions can cause a sharp increase in traffic.

Who wants to sell a site that is growing 100% every few months for some *stupid* multiple of backwards earnings? They would have to be an idiot. Certainly the public companies with a 30x P/E ratio are not trading at a 30x multiple because investors are looking backwards.

When you sell a site you must assume that they have more market data than you do. And they probably have more capital. Give them all your site specific data and you just diminish the value of your property while leaving you with no leverage.

Learning From Past Mistakes

But lots of people are stupid enough to give up the data. In the past I was one of them. A person who I mistook as a friend in our industry named a price for a partnership on one project, got as much data as he could, and then pulled out of the deal *at the price he named*!!! They claimed they lacked liquid capital, but at the same time they went on to make offers for other sites we owned (without knowing who owned them). Without even naming who the person was and only stating the above, in our forums another member guessed who it was *because the scumbag had done the exact same thing to him*

The guy was also snooping around one of my friend's sites a few years back. And so that guy asked a friend of the snooper if the snooper was legit, and the response was "we are friends, but don't trust that guy." Too bad I didn't hear that until after the guy screwed me over. But hopefully this post helps prevent you from getting screwed by fake investors and shady parties not actually interested in your properties.

Do They Eat Their Own Dog Food?

If someone tries to tell you that looting your data is part of their due diligence or purchase process send them a link to this post & tell them Aaron says hi.

Ask them how they disagree with it. And if they don't disagree with anything in this post, then tell them to give you all their business data. Fair is fair.

And if they won't share their business information with you then tell them to do the right thing...

Update

I am sick of seeing these companies take advantage of webmasters. And it appears the problem is far worse than I anticipated. Since publishing this post we have already received some emails asking for suggestions about selling sites without handing over all of their analytics data. If you want to ping us just email seobook@gmail.com, and we will see if & how we can help out. :)

Comments

Thanks Aaron, well laid out. That's just gross how these guys try to swindle your analytics data. I'm pretty guilty myself about being too honest and too trusting in this space. I think I'm a bit better now after being screwed enough but I can't change my nature 100%. I will however be much more skeptical if anybody came my way barking for analytics prior to any cash showing up in my bank.

Sorry, Aaron, I don't agree with most of what you've said.

While I appreciate that buyers can get an inside look into data they wouldn't otherwise have access to - well, that's just the way it works. If you want to sell you're going to have to accept the reality or be prepared to have a lot of buyers walk out on you.

Further, the plans the buyer has for the site are irrelevant to you, the seller. When you've come to an agreement on price, you've come to an agreement on price. It's the price at which you'd be prepared to let go of your site and ALL FUTURE REVENUE. You can't then raise the figure just because you realise the buyer has the nous and ability to make even more profit from it than YOU first expected. As a buyer, I've always walked straight away from sellers who tried to play that game. Most other buyers do too.

>>If someone tries to tell you that looting your data is part of their due diligence or purchase process send them a link to this post & tell them Aaron says hi.

You can point them here as much as you want. But if you don't allow the buyer to inspect the goods you'll simply lose your buyer. You and I don't set the rules, the most we can do is play by them. And walk away if we don't like the game.

.

It's common in higher value business purchases for the whole process to start with the seller doing a check on the buyer and his finances. Sellers of B&M businesses usually require a buyer to provide three years' worth of annual accounts. This is particulary the case if there's a seller's note involved (seller financing). If you think the buyer is going to give you access to his site stats, though, you're going to be disappointed.

You don't have to agree, but then you wouldn't given that you typically demand the opposite when buying websites, right?

There is a *large gulf* between "inspecting the goods" and "looting proprietary business data."

Sure if you trust someone you can share revenues and earnings data (and often doing that is a mistake as it creates incentive for competition even if a sale does not go through), but they don't need keyword-level data to get an idea about the general health of the business as a whole.

And I have a problem with a business throwing out a number as their offer, trying to use that number to lure someone into giving up their business data, and then saying "oh yeah we were way off, we want to pay you this lowball number instead" ... after they have all your analytics data you are screwed if a deal doesn't go through because they would likely use that data against you. Why wouldn't they?

Currently the prevailing common line of thought is that the buyer is infinitely trustworthy and should have all the leverage in the negotiation. The point of this post was to explain that as being untrue. :D

People who buy lots of websites for pennies on the Dollar may dislike this post, but oh well.

Aaron, there is no prevailing "common line of thought" on buyers being infinitely trustworthy. No idea where you got that from.

I've been a buyer, I've been a seller, I've assisted others with buying and selling sites to the tune of several million dollars. And that's just so far this year. And, no, I don't demand of sellers what I'm not willing to provide as a seller myself. That would be daft. Whether you're looking to buy or sell, ultimately it's about getting the deal done in a manner that is safe and satisfactory to all parties. I certainly don't advise sellers to approach the transaction like they're dealing with a criminal. At the bottom end of the Flippa market you get scammers whose main purpose is to learn how successful sites tick so they can attempt to reproduce that success. At the other end there are multi-million dollar deals, both broker assisted and independently conducted, where stats are provided and the deals are completed.

A buyer can't be satisfied with just revenue and earnings data. You expect him to commit to buying without seeing how much of that "free" traffic actually came from PPC? Or came from some other seller controlled property? Most sellers don't even count their uniques correctly! It's the buyer's responsibility to do the due diligence. Frustrate him in that investigative work and you might as well have not started the whole process.

Not providing the stats is not the answer, it makes you look a bit amateurish. And is more likely to lose you the deal.

How else would you explain handing over *ALL ANALYTICS DATA* free of charge as being a commonly suggested practice?

Sometimes stats are provided and no deal is done. Hence this blog post.

Yes a buyer can be satisfied with revenues and earnings data. If they expect the free organic traffic was AdWords driven then they are not expecting an honest response. And you can get the general traffic breakdown data WITHOUT needing to get data all the way down to the granular keyword level.

I would rather *be perceived* as being amateurish than to *be* a professional idiot who just gave it all way for nothing. To each their own!

If you pull back the curtain and expose the process, some of those with a vested interest in that process will address your claims. They will say you are simply wrong, that you misunderstand, are generalizing a few bad eggs as examples of the entire industry. They will also inject fear and uncertainty, so as to taint the thought process of your readers-- suggesting that it is your choice to be skeptical, but you will miss out on opportunity!

I'm sure someone in history has noted that the more there is to lose, the stronger they will work to protest your claims and skew the opinion (back into their favor).

The truth is that a "Letter of Intent" is not protection of any form, and investigators use it as a tool. The truth is that buyers who insist that sellers go along with the status quo (which is in the buyer's favor) are simply negotiating their best deal. It goes without saying that you can resist and miss out on opportunity -- that's exactly what you are doing -- choosing not to take the risk of showing your cards for free with no binding agreement in place.

Why not put up a performance bond as part of the deal? An insurance policy that supports your claim that the site is what you say it is, backed by an agreement to buy it back or whatever under very specific terms & conditions.

When buyers are able to work through the details of that, they can claim to have done "due diligence". Until then, they are less educated, less experienced, and less savvy of your business than you are, and they know it. So they hedge their bet every way they can (such as asking for all of your data up front), and try to make use of their strengths (having access to capital, knowing how to negotiate a favorable deal, etc).

Great comment John!

Too often people want to claim risk and use it to discount the terms of the deal, while also wanting to tilt everything in their favor (such that they remove almost all the risk, and such that even if the deal doesn't go through they still make plenty of money, while you get a small lump of coal).

It is almost considered sacrilege to operate out of the prescribed process put in place to give the buyer all the leverage. But they didn't put the process in place because it was what is best for the seller. Hence why it is THE PROCESS ;)

Some of these same companies try to sneak first right of refusal and other such non-sense into their affiliate contracts as well. They don't sneak that stuff in - using the small print - because it is what is best for the publisher. Why would you trust them to have the best of intentions elsewhere? No reason at all, outside of a person being naive or being one of their employees :D

Great idea on the performance bond!

>>Yes a buyer can be satisfied with revenues and earnings data.

If you've found a buyer who's willing to fork over say $500K to an unknown seller without inspecting the traffic stats, you've found yourself a mug. I'll agree that buyers don't need PPC campaign data down to the keyword, but if GA is your stats of choice you can't give a buyer access to just part of the traffic stats. Taking screen shots isn't time effective. The most you can do to protect part of your stats is to provide access via screen sharing software rather than a GA login.

>>We have had competitors clone some of our strategy in some areas,...They WILL use their capital to steamroll over you.

I'm sorry you had a bad experience. But that's not typical. Caution needs to be exerted by both sides, but it's usually the buyer who has more to lose. A single mistake during due diligence can make the $100K he just spent money down the drain.

What you seem to be arguing for is not parity but a seller paranoia where every buyer is to be viewed as someone in the negotiations not to buy but to steal traffic data. That's far from how things really work, far from an ideal attitude to take to a business transaction.

>>If a company trading at a 30x P/E multiple offers to buy your site for an 6x multiple, then they get a higher revenue cut due to their market position suddenly they have purchased your website for something like a 3x multiple... about 1/10th of what the market is valuing their enterprise at.

I'm afraid valuation doesn't work that way. The value of a business is affected not just by earnings but by risk. The higher the risk of future revenue streams not meeting the projection, the lower the multiple. A listed company is perceived as lower risk and therefore sees 30x. Websites are higher risk - there are very few websites in existence today where anybody can be reasonably sure the business model will continue for the next 30 years - and so get offers much lower than 30x. If websites were really being sold at far below their worth you wouldn't be writing about it, you'd be out there remortaging your house and buying those properties at 2x and 3x.

I hear a lot of gibberish along the lines of "Why would I want to sell if I can hold on to this site and continue to make money". Obviously not everybody feels that way as thousands of sites come on to the market every year. And the market sets the price. I've discussed NPV, DCF etc., in the valuation article you kindly linked to in a previous post: http://www.seobook.com/buying-selling-websites . Those valuation principles still hold.

Sure it is...it only takes a few minutes.

Not true at all. Its so common that when I mentioned it happening to me there were at least 4 people who told me "yeah they did it to me too."

MANY companies operate with such a strategy.

Again, simply not true. It is typically the site owner who has far more to lose. Why?

The thing you are missing is that most prospective transactions DO NOT go through. So one should approach most transactions as though they will not, such that they are not giving away their business data to competitors for nothing.

Its not really a paranoid or cynical view. Its simply viewing reality as it is. And, as I noted, the buyers are far more guarded with their own business dealings and data than they expect the sellers to be. Until there is some sort of equilibrium there then I suggest sellers demand a more reasonable mindset in terms of balancing trade offs with transactions.

If I am still alive I am sure I will still be doing quite well on the web in 30 years. I am less certain that the company referenced above will still be around. They had to raise investment funds and sell off equity to manage their debt. We are simply organically growing.

Steering clear of debt is exactly why our company is more stable than many other companies are.

Not true at all. First of all, I don't have a mortgage and did not buy into that bubble. Secondly, we prefer to grow slowly and organically rather than using debt and selling equity to build leverage. We have had investors come to us with offers on equity or buyouts, but we generally say no.

And not everybody is as driven by money as some of the sharks are. You can live comfortably on far less ambition than what some of those companies are built with.

In a discussion about your post elsewhere, someone said, "He appears to be very successful in the SEO field, but it's not too often that I see someone talking with such confidence about a topic he clearly doesn't know much about."

OTOH, your post could have been the usual blog ploy of saying something controversial to generate discussion. Fair enough.

Whatever the case, when/if you ever attempt to sell a site I wish you all the best with getting your 30x annual earnings.

Using the "some people say" angle, eh? Sorry, but this site is NOT Fox News, and that strategy is not effective here.

You can claim that the post is off base, but I don't know any other line of business where people are consistently expected to hand over all their in depth business information in exchange for NOTHING and hope that it doesn't work against their own best interests. Especially as it typically does!

If anything, I think you are naive and off base, or you haven't had the pleasure of working with some of the sharks that I have.

In the above post I explained how deceptive and scammy their pitch is ... "let me formalize that offer I just made you" ... "sure" ... "but first, give us all your stats".

That is *NOT* legitimate. At all.

I never claimed to want a 30x earning ratio for any website, but pointed that the companies which are trying the single digit multiples approach are lucky that their own companies are not viewed through the same lens, or else they would instantly lose over 2/3 of their value.

But a site which has quadrupled in under a half year could be worth a 30x multiple. Like the above mentioned site...if it was sold 6 months ago at 30x that would be like selling today at 7.5x. And 6 months from now, that price will likely be 2x or 3x. Growth is valuable, so long as you reinvest in growing the trend, which we have been and will continue to do. And with search, ranking just a couple positions higher can be worth a lot of money!

It's all about the data when it comes down to it. Anyone can replicate just about any website out there right now for cheap, so the last frontier is the data. The longer you own the site, have data, the more valuable it is because if it goes back far enough you can learn tons.

Looking at the data of seobook for example, perhaps you can learn what happened the day a algorithm changed, and what Aaron may have done to reclaim a keyword, or who has been jostling to own the top spot. Get the data from a few of those top ranked sites and you can do all sorts of things if you were a competitor.

There are plenty of free tools out there to know whether the traffic is real, so that leaves one thing in my opinion, they want to know user intent, they want to know which users are the most valuable, and they don't have to know anything about the content or the niche to see which parts of the site go CHA-CHING and implement that funnel themselves or sell that funnel as their own IP.

Just like a house, I'd do a 10% earnest money down, 30 day inspection meaning they can bring whatever consultant or analyst they want to a live screencast for analysis, but just giving them the data is like giving away the site for free.

Great post!

Great post Aaron, you make some interesting points about the backward looking nature of previous revenue especially in the first few years of the "S Curve" (Business 101) but I'm curious what you think would be the way to value the unknown future revenues of a site?

Also, in my vertical everyone knows what the "golden" keywords are and the main reason someone would benefit from buying my site would be that I have better positions than they do and they can't find a way to get in front of me (that includes PPC) so what would I care if I showed them what keywords were getting me traffic??

Well part of the point of pricing future growth estimates is using some sort of ranges (like a best and worst and some type of average), or at least acknowledging the potential growth, and increasing the premium based on it.

So if a static site trades at a 6x multiple or something like that then perhaps your site which is still growing quickly trades at closer to a 12x or 20x multiple. Or, you can wait until you are a good bit along the growth curve, and then sell it for a lower multiple.

But it almost never makes sense to sell a site growing at like 500% a year for a single digit multiple of backwards revenue. At a minimum you could take current monthly revenue * 12 to get a yearly revenue based on the current revenue, and then fix a higher multiple off of that to account for higher growth rates.

The sharing of keyword data is not just a risk in revealing the core industry keywords that everybody (and their dog) already knows to target. The bigger risk is in revealing some of the missed midtail and longtail keywords, as well as common keyword modifiers you target in some sections that the competitors missed.

I went through this last year with a very established company and did I hand over the data? Yes. Did I feel good about it? No, for exactly the reasons Aaron is talking about here. Did I feel I had any choice? No. The deal was for 7 figures (fell through on my part--I won't sell for anything less than a ridiculous amount), and I couldn't justify to myself how I could sell a site without showing the data.

Competitive search tools only show part of the story...sizeable portions of traffic could be coming from a network ring that wouldn't be in place after the sale (stats would sniff that out), stuff like that. So how does one PROVE that their site is worth $x,xxx,xxx without showing data?

Fast forward a year or so and divulging the stats don't seem to have hurt me since none of their "empire" sites seemed to have jumped on the info...however, none of the sites (that I'm aware of) really fits the niche that I'm in (which is why they wanted mine). I'm well aware there could have been an uglier outcome for me though.

I have seen entire new sections added to semi-relevant authoritative competing sites in response to a glimpse of such data. And that always turns out badly for the free web analytics data source. :(

I don't think (nor claim) that you will get screwed on every potential deal, but if you only get screwed on 20% of them AND show your stats to 5 companies (or just 1 of the rotten ones) then the odds are stacked against you!

They can get aggregate data and come up with a value estimate of the site based on that. There is no need for in depth keyword by keyword data though.

I hear you and agree 100% that handing over data is playing with fire. Even fringe sites (maybe newly created ones) could be created based on the data you provide and with their networks and media connections in place, they could build those new puppies strong enough to knock-you-out.

Spot on...the network effects can be strong, allowing them to easily come from behind to hurt you. They could buy a site 1/3 or 1/2 as strong as your site for cheap, then nepotistically cross link, and you are toast.

I was speaking with a potential new merchant partner today (a couple hours after reading this post). The merchant has several microsites in my niche...anyway, they asked me for access to my Google Analytics data so that they could put a proposal together. Huh?

Thanks for the timely cautionary reminder Aaron!

Its pretty funny that they would claim to need *any* analytics data to have you be a reseller. Sleazy, but unsurprising. Until there are about 1,000 blog posts like this one published all over the web they will keep getting away with it too.

As a veteran of the M&A field working with some of the biggest investment banks in the industry, I have never seen any Buyer follow through on an acquisition without going through proper due diligence. Even Google's purchase of YouTube required the Seller to provide full disclosure and "open books" during the diligence process. There's also legal language in the purchase agreement that protects Google, but like you said, litigation is expensive, so the smart thing is to avoid it all together. The goal of proper diligence is to find out if there are any skeletons in the closet (or for websites any black hat SEO) and avoid complications post acquisition.

Great analogy would be the process of buying an used car private party. The Buyer usually would like to check the car's Carfax, and likely take the vehicle to a trusted mechanic for an inspection. The Seller normally wouldn't ask the Buyer to disclose his/her tax returns, financial obligations, work details as long as he has the cash upfront to pay for the car. In that sense the Billion dollar purchase of a Company isn't that much different than Average Joe buying his next commuter.

For huge buyouts bought for strategic reasons where you have an amazing competitive advantage the risk of sharing data is less extreme.

But even then they wouldn't need data down to the keyword level, just the aggregate information.

As a parallel in the Youtube acquision, Youtube did *not* hand over their internal emails about how co-founder Jawid was uploading copyright content. But Jawid did hand those e-mails into the court after he got his money when Viacom sued Google ;)

Due to confidentiality provisions I will not divulge into the deal further, but I would have to disagree with your assessment on both counts. We can both maintain our opinions and agree to disagree.

I've been on the side of having a deal fall through after providing data - not to mention wanting to verify the bank deposits to back up the income claims.

Here is what I know after the process:

1. There is enough data out there already that you shouldn't need to give out more info.

Use compete.com, Alexa, Google "site keywords x traffic x position"

The only thing that should be required is maybe a GA screenshot showing traffic and sources.. that's it. If the buyer doesn't believe it - then back out of the deal. Screw off.

2. The buyer has to assume some responsibility to the future success.

This is one that really cheesed me with my deal. There were a lot of questions about how the past was, and what we expect from the future. Ummm .. That's not my problem is it? If you want to buy something you are expect to I dunno, grow the damn business yourself?

If I have a website that makes say $10k profit a month without any work, why would I sell it?

I'm most likely selling the site because

a) I've lost passion for the site

b) it doesn't make me enough money

or c) I see a downturn coming..

So it's up to the buyer to inject *new* life into the purchase.

For me the problem is the "allure" of the 6-7 figures in a deal is enough to make the seller do stupid things and it's unfortunate that brokers - who are hired by the buyer - don't protect buyers better than they do.

Add new comment