Brands vs Ads

Brand, Brand, Brand

About 7 years ago I wrote about how the search relevancy algorithms were placing heavy weighting on brand-related signals after Vince & Panda on the (half correct!) presumption that this would lead to excessive industry consolidation which in turn would force Google to turn the dials in the other direction.

My thesis was Google would need to increasingly promote some smaller niche sites to make general web search differentiated from other web channels & minimize the market power of vertical leading providers.

The reason my thesis was only half correct (and ultimately led to the absolutely wrong conclusion) is Google has the ability to provide the illusion of diversity while using sort of eye candy displacement efforts to shift an increasing share of searches from organic to paid results.

Shallow Verticals With a Shill Bid

As long as any market has at least 2 competitors in it Google can create a "me too" offering that they hard code front & center and force the other 2 players (along with other players along the value chain) to bid for marketshare. If competitors are likely to complain about the thinness of the me too offering & it being built upon scraping other websites, Google can buy out a brand like Zagat or a data supplier like ITA Software to undermine criticism until the artificially promoted vertical service has enough usage that it is nearly on par with other players in the ecosystem.

Google need not win every market. They only need to ensure there are at least 2 competing bids left in the marketplace while dialing back SEO exposure. They can then run other services to redirect user flow and force the ad buy. They can insert their own bid as a sort of shill floor bid in their auction. If you bid below that amount they'll collect the profit through serving the customer directly, if you bid above that they'll let you buy the customer vs doing a direct booking.

Adding Volatility to Economies of Scale

Where this gets more than a bit tricky is if you are a supplier of third party goods & services where you buy in bulk to get preferential pricing for resale. If you buy 100 rooms a night from a particular hotel based on the presumption of prior market performance & certain channels effectively disappear you have to bid above market to sell some portion of the rooms because getting anything for them is better than leaving them unsold.

"Well I am not in hotels, so thankfully this won't impact me" is an incomplete thought. Google Ads now offer a lead generation extension.

Dipping a bit back into history here, but after Groupon said no to Google's acquisition offer Google promptly partnered with players 2 through n to ensure Groupon did not have a lasting competitive advantage. In the fullness of time most those companies died, LivingSocial was acquired by Groupon for nothing & Groupon is today worth less than the amount they raised in VC & IPO funding.

Markets Naturally Evolve Toward Promoting Brands

When a vertical is new a player can compete just by showing up. Then over time as the verticals become established consumers develop habits, brands beat out generics & the markets get consolidated down to being heavily influenced & controlled by a couple strong players.

In the offline world of atoms there are real world costs tied to local regulations, shipping, sourcing, supply chains, inventory management, etc. The structure of the web & the lack of marginal distribution cost causes online markets to be even more consolidated than their offline analogs.

When Travelocity outsourced their backend infrastructure to Expedia most people visiting their website were unaware of the change. After Expedia acquired the site, longtime Travelocity customers likely remained unaware. In some businesses the only significant difference in the user experience is the logo at the top of the page.

Most large markets will ultimately consolidate down to a couple players (e.g. Booking vs Expedia) while smaller players lack the scale needed to have the economic leverage to pay Google's increasing rents.

This sort of consolidation was happening even when the search results were mostly organic & relevancy was driven primarily by links. As Google has folded in usage data & increased ad load on the search results it becomes harder for a generically descriptive domain name to build brand-related signals.

Re-sorting the Markets Once More

It is not only generically descriptive sorts of sites that have faded though. Many brand investments turned out to be money losers after the search result set was displaced by more ads (& many brand-related search result pages also carry ads above the organic results).

The ill informed might write something like this:

Since the Motorola debacle, it was Google's largest acquisition after the $676 million purchase of ITA Software, which became Google Flights. (Uh, remember that? Does anyone use that instead of Travelocity or one of the many others? Neither do I.)

The reality is brands lose value as the organic result set is displaced. To make the margins work they might desperately outsource just about everything but marketing to a competitor / partner, which will then latter acquire them for a song.

Travelocity had roughly 3,000 people on the payroll globally as recently as a couple of years ago, but the Travelocity workforce has been whittled to around 50 employees in North America with many based in the Dallas area.

The best relevancy algorithm in the world is trumped by preferential placement of inferior results which bypasses the algorithm. If inferior results are hard coded in placements which violate net neutrality for an extended period of time, they can starve other players in the market from the vital user data & revenues needed to reinvest into growth and differentiation.

Value plays see their stocks crash as growth slows or goes in reverse. With the exception of startups funded by Softbank, growth plays are locked out of receiving further investment rounds as their growth rate slides.

Startups like Hipmunk disappear. Even an Orbitz or Travelocity become bolt on acquisitions.

The viability of TripAdvisor as a stand alone business becomes questioned, leading them to partner with Ctrip.

TripAdvisor has one of the best link profiles of any commercially oriented website outside of perhaps Amazon.com. But ranking #1 doesn't count for much if that #1 ranking is below the fold. Or, even worse, if Google literally hides the organic search results.

TripAdvisor shifted their business model to allow direct booking to better monetize mobile web users, but as Google has ate screen real estate and grew Google Travel into a $100 billion business other players have seen their stocks sag.

Top of The Funnel

Google sits at the top of the funnel & all other parts of the value chain are compliments to be commoditized.

- Buy premium domain names? Google's SERPs test replacing domain names with words & make the words associated with the domain name gray.

- Improve conversion rates? Your competitor almost certainly did as well, now you both can bid more & hand over an increasing economic rent to Google.

- Invest in brand awareness? Google shows ads for competitors on your brand terms, forcing you to buy to protect the brand equity you paid to build.

Search Metrics mentioned Hotels.com was one of the biggest losers during the recent algorithm updates: "I’m going to keep on this same theme there, and I’m not going to say overall numbers, the biggest loser, but for my loser I’m going to pick Hotels.com, because they were literally like neck and neck, like one and two with Booking, as far as how close together they were, and the last four weeks, they’ve really increased that separation."

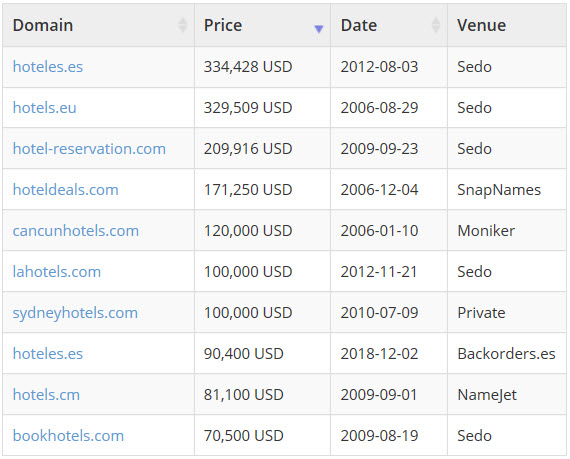

As Google ate the travel category the value of hotel-related domain names has fallen through the floor.

Most of the top selling hotel-related domain names were sold about a decade ago:

On August 8th HongKongHotels.com sold for $4,038. A decade ago that name likely would have sold for around $100,000.

And the new buyer may have overpaid for it!

Growing Faster Than the Market

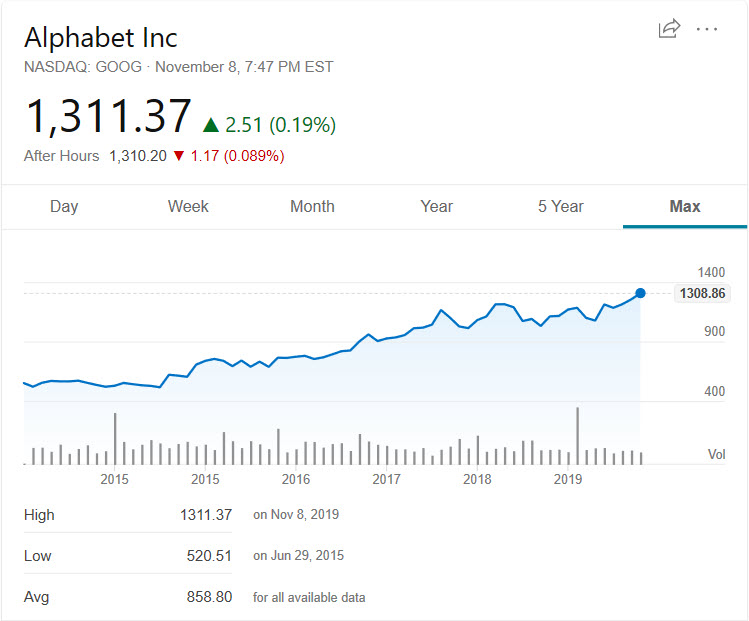

Google consistently grows their ad revenues 20% a year in a global economy growing at under 4%.

There are only about 6 ways they can do that

- growth of web usage (though many of those who are getting online today have a far lower disposable income than those who got on a decade or two ago did)

- gain marketshare (very hard in search, given that they effectively are the market in most markets outside of a few countries like China & Russia)

- create new inventory (new ad types on image search results, Google Maps & YouTube)

- charge more for clicks

- improve at targeting through better surveillance of web users (getting harder after GDPR & similar efforts from some states in the next year or two)

- shift click streams away from organic toward paid channels (through larger ads, more interactive ad units, less appealing organic result formatting, pushing organic results below the fold, hiding organic results, etc.)

Six of One, Half-dozen of the Other

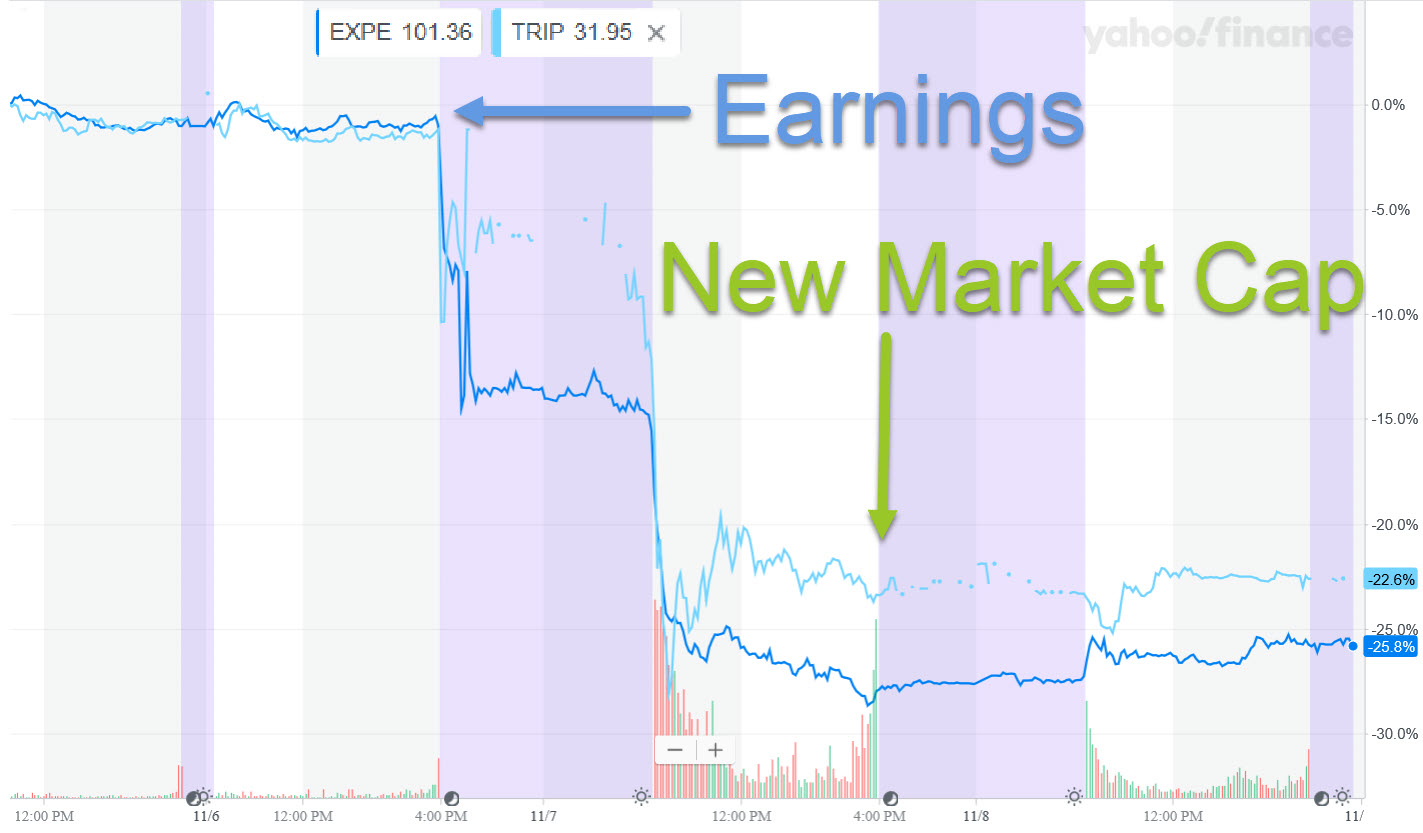

Wednesday both Expedia and TripAdvisor reported earnings after hours & both fell off a cliff: "Both Okerstrom and Kaufer complained that their organic, or free, links are ending up further down the page in Google search results as Google prioritizes its own travel businesses."

Losing 20% to 25% of your market cap in a single day is an extreme move for a company worth billions of dollars.

Thursday Google hit fresh all time highs.

"Google’s old motto was ‘Don’t Be Evil’, but you can’t be this big and profitable and not be evil. Evil and all-time highs pretty much go hand in hand." - Howard Lindzon

Booking held up much better than TripAdvisor & Expedia as they have a bigger footprint in Europe (where antitrust is a thing) and they have a higher reliance on paid search versus organic.

Frozen in Fear vs Fearless

The broader SEO industry is to some degree frozen by fear. Roughly half of SEOs claim to have not bought *ANY* links in a half-decade.

Anonymous survey: have you (or your company) purchased backlinks - of ANY quality - for your own site, or any of your clients' sites, at any point in the past ~5 years?— Lily Ray (@lilyraynyc) October 24, 2019

Long after most of the industry has stopped buying links some people still run the "paid links are a potential FTC violation guideline" line as though it is insightful and/or useful.

Some people may be violating FTC rules by purchasing links that are not labeled as sponsored. This includes "content marketers" who publish articles with paid links on sites they curate.

It's a ticking time bomb because it's illegal.— Roger Montti (@martinibuster) October 24, 2019

Ask the people carrying Google's water what they think of the official FTC guidance on poor ad labeling in search results and you will hear the beautiful sound of crickets chirping.

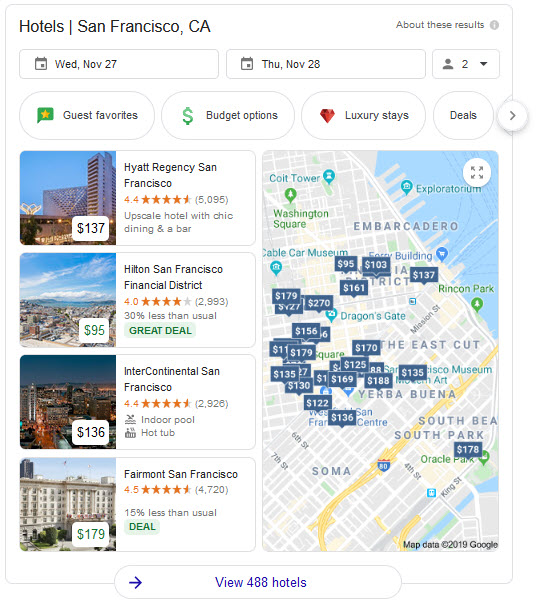

Where is the ad labeling in this unit?

Does small gray text in the upper right corner stating "about these results" count as legitimate ad labeling?

And then when you scroll over that gray text and click on it you get "Some of these hotel search results may be personalized based on your browsing activity and recent searches on Google, as well as travel confirmations sent to your Gmail. Hotel prices come from Google's partners."

Ads, Scroll, Ads, Scroll, Ads...

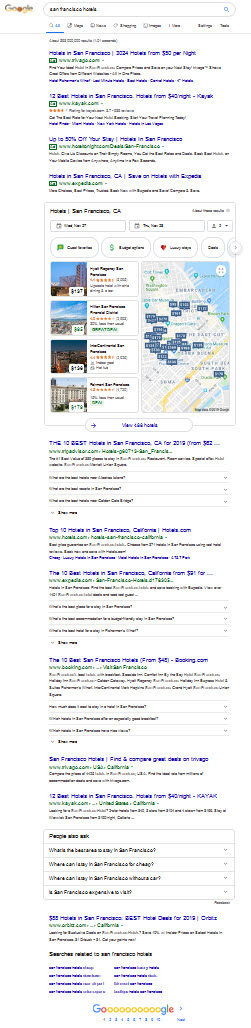

Zooming out a bit further on the above ad unit to look at the entire search result page, we can now see the following:

- 4 text ad units above the map

- huge map which segments demand by price tier, current sales, luxury, average review, geographic location

- organic results below the above wall of ads, and the number of organic search results has been reduced from 10 to 7

How many scrolls does one need to do to get past the above wall of ads?

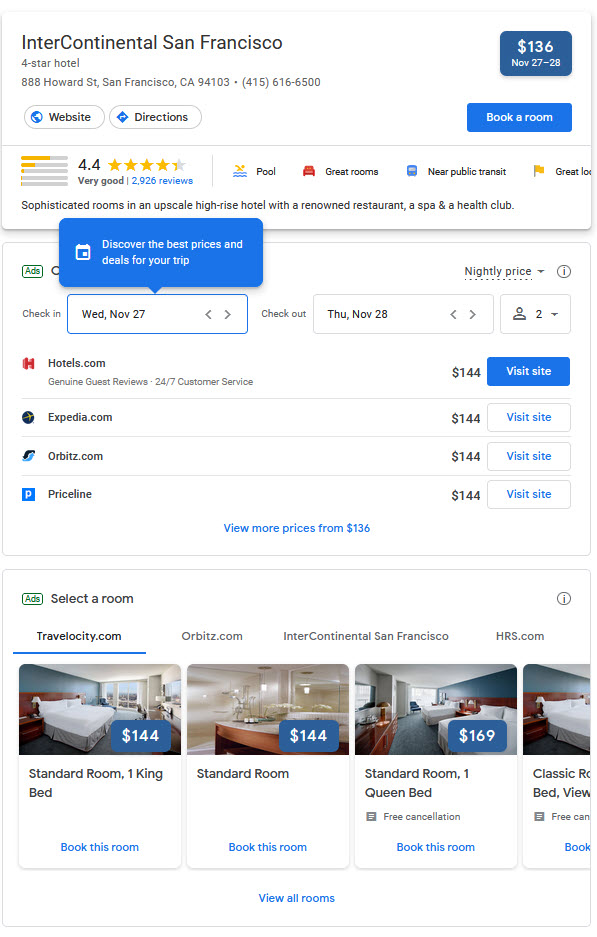

If one clicks on one of the hotel prices the follow up page is ... more ads.

Check out how the ad label is visually overwhelmed by a bright blue pop over.

Defund

It is worth noting Google Chrome has a built-in ad blocking feature which allows them to strip all ads from displaying on third party websites if they follow Google's best practices layout used in the search results.

You won't see ads on websites that have poor ad experiences, like:

- Too many ads

- Annoying ads with flashing graphics or autoplaying audio

- Ad walls before you can see content

When these ads are blocked, you'll see an "Intrusive ads blocked" message. Intrusive ads will be removed from the page.

The following 4 are all true:

- Google buys entire businesses, guts them & sells them for parts.

- Google's core business model is selling paid links with ever lighter disclosure.

- Some SEOs suggest selling links or exposure is beneath them.

- Ex-Google employees leverage their past gains to buy well linked sites like Money.com.

And, as a bonus, to some paid links are a crime but Google can sponsor academic conferences for market regulators while requesting the payments not be disclosed.

Excessive Profits = Spam

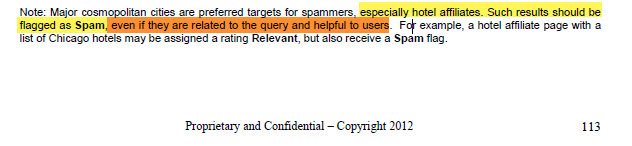

Hotels have been at the forefront of SEO for many years. They drive massive revenues & were perhaps the only vertical ever referenced in the Google rater guidelines which explicitly stated all affiliate sites should be labeled as spam even if they are helpful to users.

Google has won most of the profits in the travel market & so they'll need to eat other markets to continue their 20% annual growth.

As they grow, other markets disappear.

"It's a bug that you could rank highly in Google without buying ads, and Google is trying to fix the bug." - Googler John Rockway, January 31, 2012

Some people who market themselves as SEO experts not only recognize this trend but even encourage this sort of behavior:

Zoopla, Rightmove and On The Market are all dominant players in the industry, and many of their house and apartment listings are duplicated across the different property portals. This represents a very real reason for Google to step in and create a more streamlined service that will help users make a more informed decision. ... The launch of Google Jobs should not have come as a surprise to anyone, and neither should its potential foray into real estate. Google will want to diversify its revenue channels as much as possible, and any market that allows it to do so will be in its sights. It is no longer a matter of if they succeed, but when.

If nobody is serving a market that is justification for entering it. If a market has many diverse players that is justification for entering it. If a market is dominated by a few strong players that is justification for entering it. All roads lead to the pile of money. :)

Extracting information from the ecosystem & diverting attention from other players while charging rising rents does not make the ecosystem stronger. Doing so does not help users make a more informed decision.

Information as a Vertical

The dominance Google has in core profitable vertical markets also exists in the news & general publishing categories. Some publishers get more traffic from Google Discover than from Google search. Publishers which try to turn off Google's programmatic ads find their display ad revenues fall off a cliff:

"Nexstar Media Group Inc., the largest local news company in the U.S., recently tested what would happen if it stopped using Google’s technology to place ads on its websites. Over several days, the company’s video ad sales plummeted. “That’s a huge revenue hit,” said Tony Katsur, senior vice president at Nexstar. After its brief test, Nexstar switched back to Google." ... "Regulators who approved that $3.1 billion deal warned they would step in if the company tied together its offerings in anticompetitive ways. In interviews, dozens of publishing and advertising executives said Google is doing just that with an array of interwoven products."

News is operating like many other (broken) markets. The Salt Lake Tribune converted to a nonprofit organization.

Many local markets have been consolidated down to ownership by a couple private equity shop roll ups looking to further consolidate the market. Gatehouse Media acquired Gannett & has a $1.8 billion mountain of debt to pay off.

McClatchy - the second largest domestic newspaper chain - may soon file for bankruptcy:

there’s some nuance in this new drama — one of many to come from the past decade’s conversion of news companies into financial instruments stripped of civic responsibility by waves of outside money men. After all, when we talk about newspaper companies, we typically use their corporate names — Gannett, GateHouse, McClatchy, MNG, Lee. But it’s at least as appropriate to use the names of the hedge funds, private equity companies, and other investment vehicles that own and control them.

The Washington Post - owned by Amazon's Jeff Bezos - is creating an ad tech stack which serves other publishers & brands, though they also believe a reliance on advertiser & subscription revenue is unsustainable: “We are too beholden to just advertiser and subscriber revenue, and we’re completely out of our minds if we think that’s what’s going to be what carries us through the next generation of publishing. That’s very clear.”

Future Prospects

We are nearing inflection points in many markets where markets that seemed somewhat disconnected from search will still end up being dominated by Google. Gmail, Android, Web Analytics, Play Store, YouTube, Maps, Waze ... are all additional points of leverage beyond the core search & ads products.

If all roads lead to money one can't skip healthcare - now roughly 20% of the United States GDP.

Google scrubbed many alternative health sites from the search results. Some of them may have deserved it. Others were perhaps false positives.

Google wants to get into the healthcare market in a meaningful way. Google bought Fitbit and partnered with Ascension on a secret project gathering health information on over 50 million Americans.

Google is investing heavily in quantum computing. Google Fiber was a nothingburger to force competing ISPs into accelerating expensive network upgrades, but beaming in internet services from satellites will allow Google to bypass local politics, local regulations & heavy network infrastructure construction costs. A startup named Kepler recently provided high-bandwidth connectivity to the Arctic. When Google launches a free ISP there will be many knock on effects causing partners to long for the day where Google was only as predatory as they are today.

"Capitalism is an efficient system for surfacing and addressing the needs of consumers. But once it veers toward control over markets by a single entity, those benefits disappear." - Seth Godin

Comments

Thanks Aaron. Google just seems evil these days. What can we do? Use a different search engine and tell everyone we know to do the same?

...change happens one person at a time.

Other important aspects would be things like not supporting new & proprietary publishing formats they create, using the semi-open-source alternatives to their core offerings like Chromium over Chrome, ensuring if you publish on their platforms there are extra parts on your site which add value to the version on your site & make it the canonical resource for the topic, etc.

And then the other important thing would be to have a diverse set of revenue streams and/or a good chunk of savings so that if anything goes away you still can approach things rationally vs emotionally. Ideally you make many small bets and incrementally invest in wins versus making large "bet the farm" bets that can blow up in your face. You want to be able to survive even if you have bad luck, bad timing & make a few bad decisions.

I've had a lot of really shitty things happen over the past 2 or 3 years so I sort of let this blog wither. Had I wrote more frequently over the years there would probably be more than a single comment on this post. :)

And then the remaining concept would be in some cases it could make sense to invest in either momentum or mean reversion. The below is not specific investing advice catering toward anyone, but just some ideas or examples.

Almost any form of active investing (other than momentum investing) is betting against consensus views. The hard thing about investing against consensus is some combo of...

For many/most people trading stocks is exhausting & a distraction. Most people are probably better off investing actively in their own business and more passively in the capital markets.

Thanks for the article. It seems that Google is just working for the Big Corporations now. Ads are overflowing in the SERP's.

Man, I've been saying this for years, glad someone smart enough has put in all in perfect order to understand the manipulation. Google's behavior is like someone destroying a few microbes on an anthill in Africa. Problem is, we are the microbes. https://getyarn.io/yarn-story/b645e1b6-5740-4d7b-b237-f2ed636713a5#SkteH...

They do like most companies do. They launched by sending you free stuff for a while, they they slowy changed to paid.

Do you think removing the middle man will result in reduced marketing costs for hotel brands as they will not have to pay heavily commissioned fees to a "middle man".

...the fewer sources there are to buy from the less choice there is in the decision to buy & the less ability there is to bargain against multiple competitors for a reasonable deal.

When choice is removed from the marketplace eventually that drives up cost (or revshare passed onto the partner administering the "market"), drives down quality of customer service, or both.

The cost part can be...

The quality of customer service going down could mean many smaller hotels lacking sufficient spend are required to join a chain (another middleman!) to have enough heft to get a reasonable deal or to even be allowed to participate in the ecosystem at all.

Long ago Larry Page stated he thought the idea of customer support was ridiculous:

That is the sort of approach you can only really get from a monopoly. And it is certainly counter to the concept of hospitality.

As Google has grown stronger they haven't become less abusive.

That Larry Page customer service quote remains fresh in my memory because I recently went to boost a client's post on Facebook & was unable to because my ad account was flagged for potential payment fraud. They've hit my card for thousands, never seen a reverse charge, had ads run on and off for a half-decade or more. But one better not travel internationally and/or use a VPN because those could indicate fraud.

That ad account has never promoted sketchy affiliate offers or any sort of crap like that. Just the idea of traveling or using a VPN means it was repeatedly blocked. And if it got unblocked it would be for a couple days and then another blockeroo.

A small startup that has collected thousands in ad revenues from an advertiser would probably be slow to ban advertisers for potential payment issues if their ad accounts are aged and they've never done a reverse charge. But to a monopoly a couple grand here & a couple grand here is utterly meaningless.

And the bigger joke hidden in there is Facebook wants to launch a global cryptocurrency project called Libra, so that when you are blocked or deplatformed you are entirely depersoned. I'd probably carry around silver coins and try to use those to pay for stuff before I considered Libra after the above experience.

"Had I wrote more frequently over the years there would probably be more than a single comment on this post. :)"

I know there are a few more comments now, but pop this URL in Twitter search and I think you might like all the (deserved) mentions this piece is getting.

I think you were the first person I ever interviewed on the web. Welcome back, Aaron.

... I am not sure if it is my low writing frequency prevents this site from becoming any sort of reading habit, or if the content itself is not particularly commentworthy, or if conversation has largely moved away from blogs onto social networks for the most part.

I think what drove a sort of second wave of interest for this blog post was when Seth Godin mentioned it. He is a great writer & ensures he writes daily. His stuff is easy to read and usually rather uplifting, so very easy to keep reading his blog as a habit even after one's favorite feed reader or such has went away.

I see you've done rather well since way back then. Congrats on all the success Glen!

Hi, I wandered over here from Matt Stollers' page.

I've been a lurker on the internet since before there was a web. Which tends to mean I don't write anything unless I can do so without signing my name.

Anyhow, sometimes an image or idea gets stuck in my mind... Makes me wish I could print out a bunch of T-Shirts and open a pop-up store for a day or two...

Past week I keep getting this image of a cartoon panel. A little boy, a kid, who looks a lot like Calvin, from "Calvin and Hobbes'; just sitting in a room at his computer. The computer had a plume of dark smoke issuing up and out of it. And the Kid is yelling over his shoulder to his mother:

"MA!!! GOOGLE BROKE THE INTERNET AGAIN!"

For so many, google is synonymous with the internet. That needs to change. I remember how easy and joyful the internet was, once... Anyhow. I thought this was a cool meme to break the presumption that proprietary and open standards can coexist in a free society. Have a nice day.

* retreats to the Lurker-verse *

...like India and the Philippines Facebook is perhaps even more dominant than Google is, which is part of why they got such a backlash on their Free Basic offering.

Aaron, fantastic piece, thank you. Illuminating and depressing at the same time.

We rely on Image Search to drive organic traffic through to our web properties as it is a relatively untouched area.

(You can leverage it by creating Content Upgrades that show up right in the Image Search. i.e. "Get the eBook" graphic that relates to your search query)

I think that Google is becoming a lot more interested in what you referred to as the eye-candy of the SERP. Humans are far more motivated toward images than a long slab of text.

We're seeing massive changes in the Image Search section such as a move towards Pinterest-like tabs/categories and monetisation of results. Lots of changes/testing.

It won't be long until Google sucks up the image-oriented Houzz model and starts selling houses too!

Then, perhaps, they'll own all the virtual and non-virtual land.

For a while Google changed how they configured the links to image publishers to eat most the image search traffic for itself (at least inside the United States). They later changed their approach toward sending a good bit more traffic back to the original publisher sites.

I don't know what drove their change of heart:

...but glad to hear you found something that is working well for you right now.

On another related antitrust note, at one point in time Google's remote rater guidelines stated images which are watermarked should be rated lower than images which are not watermarked. Those who preserved some level of property rights & wanted credit for their work got downranked. Preserving the ability to recycle content flows trust, authority and attention to the aggregator.

And then they were playing semantic games with their ability (or willingness) to filter illegal images which had already been removed with each new upload being another whack-a-mole game. On one hand they claim to have had the world's most advanced AI that could train itself entities from unlabeled images and videos, yet on the other hand the same illegal image being uploaded again and again and again required yet another round of DMCA removal requests.

I dub thee the Leonard Cohen of Search...

Welcome back, Aaron!

I don't usually comment on stuff, but just wanted to let you know that 3+ months later I'm still coming back to this article now and then to keep a realistic perspective on Google. So valuable. Thanks.

This is really good – and helps me understand what markets to avoid. While increasing my anxiety for our current niche. Very much appreciate the time it took to put together this journalism!

Add new comment