Should Venture Backed Startups Engage in Spammy SEO?

Here's a recent video of the founders of RapGenius talking at TechCrunch disrupt.

Oops, wrong video. Here's the right one. Same difference.

Recently a thread on Hacker News highlighted a blog post which pointed how RapGenius was engaging in reciprocal promotional arrangements where they would promote blogs on their Facebook or Twitter accounts if those bloggers would post a laundry list of keyword rich deeplinks at RapGenius.

Matt Cutts quickly chimed in on Hacker News "we're investigating this now."

A friend of mine and I were chatting yesterday about what would happen. My prediction was that absolutely nothing would happen to RapGenius, they would issue a faux apology, they would put no effort into cleaning up the existing links, and the apology alone would be sufficient evidence of good faith that the issue dies there.

Today RapGenius published a mea culpa where ultimately they defended their own spam by complaining about how spammy other lyrics websites are. The self-serving jackasses went so far as including this in their post: "With limited tools (Open Site Explorer), we found some suspicious backlinks to some of our competitors"

It's one thing to in private complain about dealing in a frustrating area, but it's another thing to publicly throw your direct competitors under the bus with a table of link types and paint them as being black hat spammers.

Google can't afford to penalize Rap Genius, because if they do Google Ventures will lose deal flow on the start ups Google co-invests in.

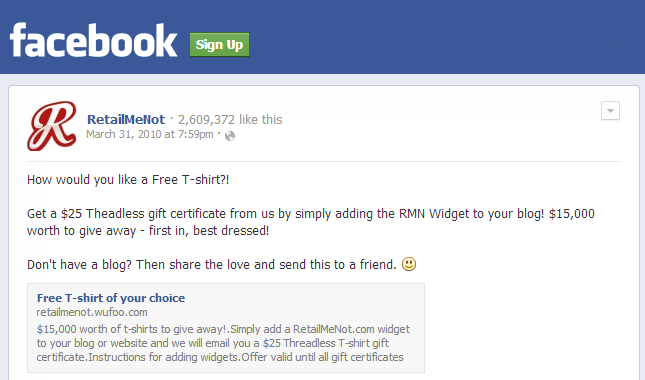

In the past some of Google's other investments were into companies that were pretty overtly spamming. RetailMeNot held multiple giveaways where if you embedded a spammy sidebar set of deeplinks to their various pages they gave you a free t-shirt:

Google's behavior on such arrangements has usually been to hit the smaller players while looking the other way on the bigger site on the other end of the transaction.

That free t-shirt for links post was from 2010 - the same year that Google invested in RetailMeNot. They did those promotions multiple times & long enough that they ran out of t-shirts!. The widgets didn't link to the homepage of RetailMeNot or pages relevant to that particular blog, rather they used (in some cases dozens of different) keyword rich deep links in each widget - arbitraging search queries tied various third party brands. Now that RTM is a publicly traded billion Dollar company which Google already endorsed by investing in, there's a zero percent chance of them getting penalized.

To recap, if you are VC-backed you can: spam away, wait until you are outed, when outed reply with a combined "we didn't know" and a "our competitors are spammers" deflective response.

For the sake of clarity, let's compare that string of events (spam, warning but no penalty, no effort needed to clean up, insincere mea culpa) to how a websites are treated when not VC backed. For smaller sites it is "shoot on sight" first and then ask questions later, perhaps coupled with a friendly recommendation to start over.

Here's a post from today highlighting a quote from Google's John Mueller:

My personal & direct recommendation here would be to treat this site as a learning experience from a technical point of view, and then to find something that you're absolutely passionate & knowledgeable about and create a website for that instead.

Growth hack inbound content marketing, but just don't call it SEO.

Growth hacking = using 2005-era spam tactics. http://t.co/5ISCPmMEkp cc @samfbiddle @nitashatiku

— Max Woolf (@minimaxir) December 23, 2013What's worse, is with the new fearmongering disavow promotional stuff, not only are some folks being penalized for the efforts of others, but some are being penalized for links that were in place BEFORE Google even launched as a company.

Google wants me to disavow links that existed back when backrub was foreplay and not an algo. Hubris much?

— Cygnus SEO (@CygnusSEO) December 21, 2013Given that money allegedly shouldn't impact rankings, its sad to note that as everything that is effective gets labeled as spam, capital and connections are the key SEO "innovations" in the current Google ecosystem.

Comments

Hello Aaron,

it's wonderful to see that some of the SEO leaders is not eunuch but brave enough to call a spade a spare.

My respect,

Gour

Awesome report. Aaron please take a look at this article on Expedia's link buying quest. Might be interesting for your readers nenadseo.com/new-seo/

It looks like Rap Genius was penalized by Google:

How long will that penalty last? Odds are it is more aligned with a week than over a month.

If you're a small player (i.e. 99.99% of the web), then these penalties are essentially death sentences. Sure, there's reports of partial recoveries or rare full recoveries, but the average site owner has no chance to get back to where they were. Irrelevant if it was negative SEO or not. Irrelevant if their site is actually USEFUL or not. Google want to thin the herd for their own expedient reasons.

Big companies just do an Interflora and go through the motions and within a week to 10 days Google have them ranking where they once were.

"If you want a vision of the future, imagine a boot stamping on a human face - forever" (Orwell). The sheer repetition of Google hammering small businesses over and over and over and over and over and over with 100% impunity - while Google continue to dominate the web - reminds me of a kind of fascism (authority and control over huge numbers under a single dictatorship). 2014 will be just another year of Google hammering small business owners.

Anyone who was there in 1999 recognizes the parallels.... The intentional cultural disconnect, the fake hipsters w Ivy League pedigrees playing the middle age Silicon Valley nerds for 15m while relying completely on teens for revenue potential via fast growth and trend tracking.

Perhaps most interesting is watching the media that air the stories and provide the personalities behind the interview mics (and I use the word personality courteously). They will go first.

Back then so many new age start ups would do cross-promotional deals where they would "buy" ad inventory from one another at inflated above-market prices, such that they could book the revenues AND claim they were investing in growing their audience - justifying the infinite P/E ratios on negative earnings.

Now with ad exchanges it is perhaps a bit harder to inflate ad rates above rational prices (unless one runs a social platform and can sell their own exclusive ad units where they claim that fat thumb mobile clicks on the retweet button are worth $1 or $2 each & that one is getting on the "ground floor" at those rates - but even that sort of stuff will have a limited shelf life). There aren't as many dogcrap IPOs today as there were then, but some of the social media stocks are certainly priced to perfection.

The flip side of the coin today is debt leverage. All the stories about companies having record cash leave out a couple issues like: them also having record debt, stocks being priced at far higher multiples (when one looks at tangible assets less debt) than recent history, bank assets being priced at phoney valuations (the market bottomed in 2009 when the FASB relaxing mark-to-market accounting rules), nearing the end of a 30+ year bull run in bonds, etc.

Just yesterday Crocs stock popped on news that they were taking a $200 million investment from Blackstone. The company is ALREADY losing money on a per-share basis, and is a worn out trend play. They are taking a $200 million investment & are not using it to upgrade their line or do anything that directly impacts production or marketing, but are using it to buy back shares outstanding. Shareholders get future dilution from the investment that will allow for the creation of preferred shares for the investor & in the short term they get to increase your per-share losses as the company buys stock at inflated prices after the stock pops on news of the investment.

Also worth mentioning that when the Federal Reserve was buying garbage assets from banks it made sense to pay par (as banking oligarchies are more important than human beings are), but when these leveraged financial engineering plays make their investments, quite often a lot of the returns are driven by debt renegotiations:

Of course if you are an individual & are over-leveraged you become grist for the economic machine & the dynasties that run it.

It came back closer to 1 week than 1 month. http://www.businessinsider.com/rap-genius-is-back-in-googles-rankings-20...

Aaron!

This is Bryan Knowlton over at the Daily Blogcast for Internet Marketing.

I just wanted to let you know we discussed your blog post on our show and would love if you could help get the word out to your readers!

Episode 043 – Google uses Spam Penalty on Rap Genius, John Chow on ShoeMoneys Affiliate Summit Documentary, Matt Cutts on expired domain names with penalty durations

http://dailyblogcast.net/2014/01/06/043-google-uses-spam-penalty-on-rap-...

We found the article to be well written and decided to feature it in this episode. If you would like to provide any additional comments, you can do that directly at the bottom of the page listed above.

Since this is a Daily Podcast, we will definitely be visiting your blog from time to time to find more great articles to discuss. If you would like to leave us a comment, question or a voicemail, you can do that on the right side of the page.

Again, thank you for the blog post! Without it we might have not had much to talk about! :)

You can subscribe (or let your readers they can) at http://dailyblogcast.net/itunes

Thanks again!

Bryan & Mark

Daily Blogcast for Internet Marketing - Because reading is hard...

Add new comment