Late Funnel SEO Profits

Before the Panda update SEOs could easily focus almost all their energies on late funnel high-intent searches which were easy to monetize without needing to put a ton of effort into brand building or earlier funnel informational searches. This meant that SEOs could focus on phrases like [student credit cards] or [buy earbuds] or [best computer gaming headphones] or [vertical computer mouse] without needing to worry much about anything else. Make a good enough page on those topics, segment demand across options, and profit.

Due to the ability to focus content & efforts on those tiny subset high-intent commercial terms the absolute returns and CPMs from SEO investments were astronomical. Publishers could insert themselves arbitrarily just before the end of the value chain (just like Google AdWords) and extract a toll.

The Panda Shift / Eating the Info Supply Chain

Then Panda happened and sites needed to have stronger brands and/or more full funnel user experience and/or more differentiated content to be able to rank sustainably.

One over-simplified way to think of Panda and related algorithms would be: brand = rank.

Another way to look at it would be to consider the value chain of having many layers or pieces to it & Google wanting to remove as many unneeded or extra pieces from the chain as possible so that they themselves are capturing more of the value chain.

- That thin eHow article about a topic without any useful info? Not needed.

- The thin affiliate review which was buying Google AdSense ad impressions on that eHow article? Also not needed.

- All that is really needed is the consumer intent, Google & then either Google as the retailer (pay with your credentials stored in your phone) or another trusted retailer.

In some cases there may be value in mid-market in-depth reviews, but increasingly the aggregate value offered by many of them is captured inside the search snippets along with reviews directly incorporated into the knowledge graph & aggregate review scores.

The ability to remove the extra layers is driven largely by:

- the quality of the top players in the market

- the number of quality publishers in a market (as long as there are 2 or more, whoever is not winning will be willing to give a lot of value to Google to try to play catch up against their stronger competitor)

- the amount of usage data available in the market

- the ad depth of the market

If your competitor is strong and they keep updating in-depth content pieces you can't set and forget your content and stay competitive. Across time searcher intent changes. Those who change with the markets should eventually have better engagement metrics and keep winning marketshare.

Benchmarking Your Competition

You only have to be better than whatever you are competing against to win.

If you have run out of ideas from your direct competitors in an emerging market you can typically find many more layers of optimization from looking at some of the largest and most successful players inside either the United States or China.

To give an example of how user data can be clean or a messy signal consider size 13 4E New Balance shoes. If you shop for these inside the United States a site like Amazon will have shoe size filters so you can see which shoes from that brand are available in that specific size.

In some smaller emerging markets ecommerce sites largely suck. They might allow you to filter shoes by the color blue but wanting to see the shoes available in your size is a choose your own adventure game as they do not offer those sorts of size filters, so you have to click into the shoe level, find out they do not have your size, and then try again. You do that about 100 times then eventually you get frustrated and buy off eBay or Amazon from someone who ships internationally.

In the first case it is very easy for Google to see the end user flow of users typically making their purchase at one of a few places like Amazon.com, the official New Balance store, or somewhere else like that which is likely to have the end product in stock. That second experience set is much harder to structure because the user signal is much more random with a lot more pogos back to Google.

Bigger, Better Ads

Over the past couple decades Google has grown much more aggressive at monetizing their search results. A website which sees its rank fall 1 position on mobile devices can see their mobile search traffic cut in half overnight. And desktop search results are also quite ad heavy to where sometimes a user can not see a single full organic result above the fold unless they have a huge monitor.

We tend to look at the present as being somewhat static. It is a part of human nature to think things are as they always were. But the general trend of the slow bleed squeeze is a function of math and time: "The relentless pressure to maintain Google’s growth, he said, had come at a heavy cost to the company’s users. Useful search results were pushed down the page to squeeze in more advertisements, and privacy was sacrificed for online tracking tools to keep tabs on what ads people were seeing."

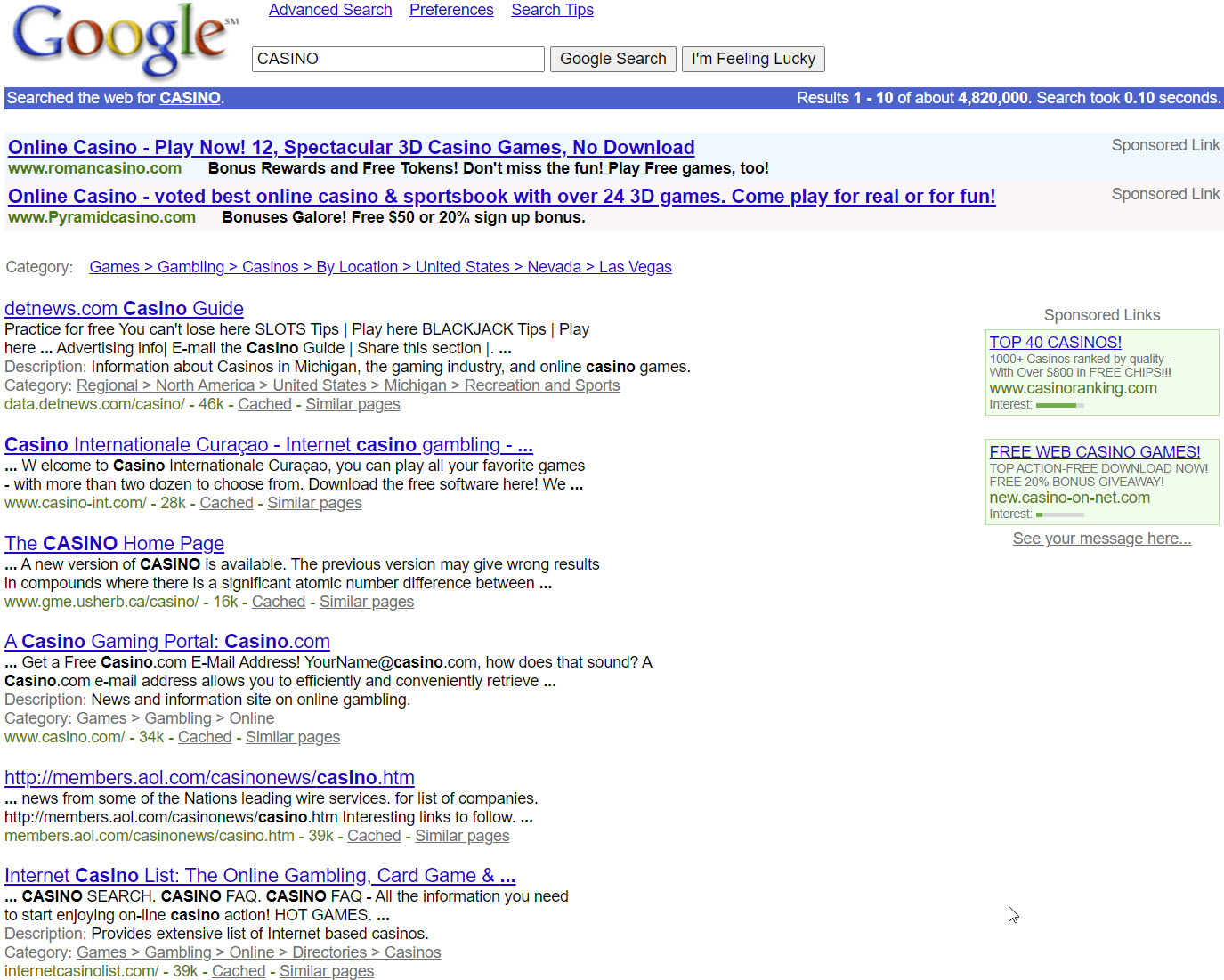

Some critics have captured the broad shift in ad labeling practices, but to get a grasp of how big the shift has been look at early Google search results.

Look at how bright those ad units from 2001 are.

Since then ad labeling has grown less intuitive while ad size has increased dramatically.

Traffic Mix Shift

As publishers have been crowded out on commercial searches via larger ads & Google's vertical search properties a greater share of their overall search traffic is lower value visitors including people who have little to no commercial intent, people from emerging markets with lower disposable income and

Falling Ad Rates

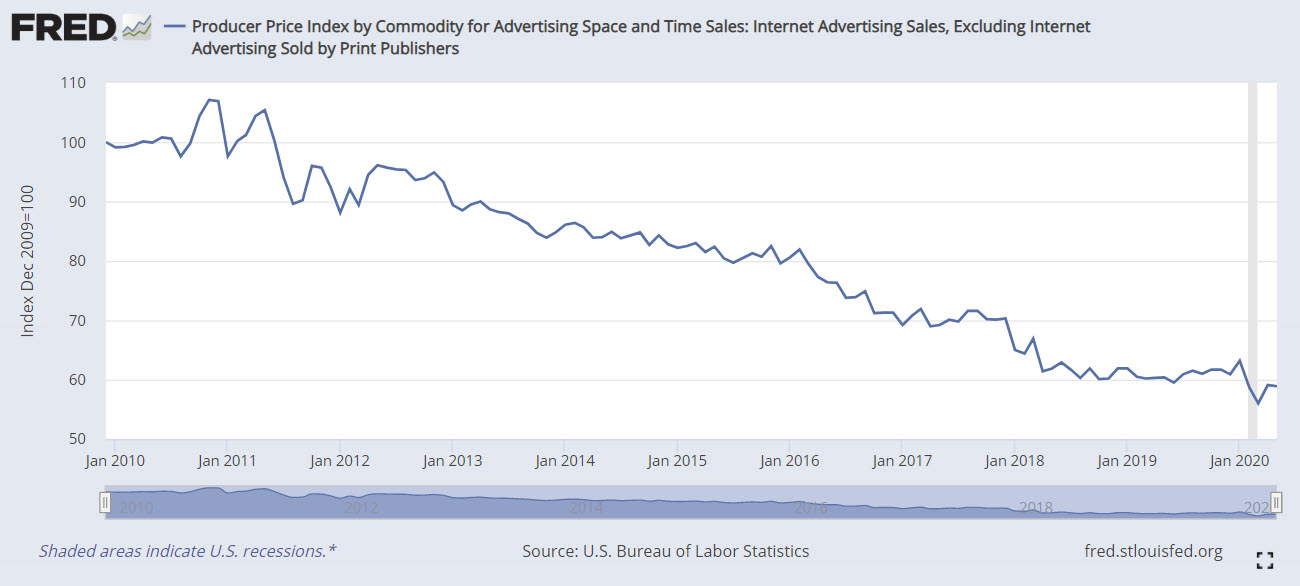

Since 2010 online display ad rates have fallen about 40%.

Any individual publisher will experience those declines in a series of non-linear step function shifts. Any of the following could happen:

- Google Panda or another algorithm update from a different attention merchant hits your distribution hard

- a Softbank-backed competitor jumps into your market and gains a ton of press coverage using flammable money

- a roll-up player buys out a series of sites in the supply chain & then tries to make the numbers back out by cramming down on ad syndication partners (sometimes you have to gain enough scale to create your own network or keep rotating through ad networks to keep them honest)

- regulatory costs hit any part of the supply chain (the California parallel to GDPR just went live this month)

- consumer interest shifts to other markets or solutions (the mobile phone has replaced many gadgets)

- a recession causes broad-based advertiser pullbacks

Margin Eaters

In addition to lowering ad rates for peripheral websites, there are a couple other bonus margin eaters.

Junk Sunk Costs

Monopoly platforms push publishers to adopt proprietary closed code bases in order to maintain distribution: "the trade group says Google's Accelerated Mobile Pages (AMP) format was foisted on news publishers with an implied threat — their websites wouldn't show up in search results."

Decreased Supply Chain Visibility

Technical overhead leading to programmatic middlemen eating a huge piece of the pie: "From every £1 spent by an advertiser, about half goes to a publisher, roughly 16p to advertising platforms, 11p to other technology companies and 7 per cent to agencies. Adtech companies that took part in the study included Google’s dv360 and Ad Manager, Amazon Advertising and the Rubicon Project."

Selection Effect

Large attention merchants control conversion tracking systems and displace organic distribution for brands by re-routing demand through a layer of ads which allows the central network to claim responsibility for conversions which would have already happened had they not existed.

Internal employees in the marketing department and external internet marketing consultants have an incentive to play along with this game because:

- it requires low effort to arbitrage your own brand

- at first glance it looks wildly profitable so long as you do not realize what is going on

- those who get a percent of spend can use the phantom profits from arbitraging their own brand equity to spend more money elsewhere

- those who get performance based bonuses get a bonus without having to perform

Both eBay and Microsoft published studies which showed how perverse selection effect is.

The selection effect bias is the inverse of customer acquisition cost. The more well known your brand is the more incentive ad networks have to arbitrage it & the more ad networks will try to take credit for any conversion which happens.

These margin eaters are a big part of the reason so many publishers are trying to desperately shift away from ad-based business models toward subscription revenues.

Hitting Every Layer

The commodification of content hits every layer from photography....

...on through to writing

...and every other layer of the editorial chain.

Profiting from content creation at scale is harder than most appreciate.

The idea that a $200 piece of content is particularly cheap comes across as ill-informed as there are many headwinds and many variables. The ability to monetize content depends on a ton of factors including: how commercial is it, how hard is it to monetize, what revshare do you go, how hard is it to rank or get distribution in front of other high intent audience sets?

If an article costs $200 it would be hard to make that back if it monetizes at anything under a $10 RPM. 20,000 visits equates to 20 units of RPM.

Some articles will not spread in spite of being high quality. Other articles take significant marketing spend to help them spread. Suddenly that $200 "successful" piece is closer to $500 when one averages in nonperformers that don't spread & marketing expenses on ones that do. So then they either need the RPM to double or triple from there or the successful article needs to get at least 50,000 visits in order to break even.

A $10 RPM is quite high for many topics unless the ads are quite aggressively integrated into the content. The flip side of that is aggressive ad integration inhibits content spread & can cause algorithmic issues which prevent sustained rankings. Recall that in the most recent algorithm update Credit Karma saw some of their "money" credit card pages slide down the rankings due to aggressive monetization. And that happened to a big site which was purchased for over $7 billion. Smaller sites see greater levels of volatility. And nobody is investing $100,000s trying to break even many years down the road. If they were only trying to break even they'd buy bonds and ignore the concept of actively running a business of any sort.

Back in 2018 AdStage analyzed the Google display network and found the following: "In Q1 2018, advertisers spent, on average, $2.80 per thousand impressions (CPM), and $0.75 per click (CPC). The average click-through rate (CTR) on the GDN was 0.35%."

A web page which garnered 20,000 pageviews and had 3 ad units on each page would get a total of 210 ad clicks given a 0.35% ad CTR. At 75 cents per click that would generate $157.50.

Suddenly a "cheap" $200 article doesn't look so cheap. What's more is said business would also have other costs beyond the writing. They have to pay for project management, editorial review, hosting, ad partnerships & biz dev, etc. etc. etc.

After all those other layers of overhead a $200 article would likely need to get about 50,000 pageviews to back out. And a $1,000 piece of content might need to get a quarter million or more pageviews to back out.