You’ve got to feel a little sorry for anyone new to the search marketing field.

On one side, they’ve got to deal with the cryptic black box that is Google. Often inconsistent, always vague, and can be unfair in their dealings with webmasters. On the other side, webmasters must operate in competitive landscapes that often favour incumbent sites, especially if those incumbents are household names.

Sadly, much of the low hanging search fruit is gone. However, there are a number of approaches to optimization that don’t involve link placement and keyword targeting.

Competitive Advantage

Like any highly active and lucrative market sector, the web business can be challenging, but complaining about the nature of the environment will do little good. The only real option is to grab some boxing gloves, jump in the ring and compete.

In the last post, we talked about measurement. We need to make sure we’re measuring the right things in order to win. This post is about measuring our competitors to see if we enjoy a competitive advantage. If not, we need to rethink our approach.

Underlying Advantages

One of the problems with counting links, and other popular SEO metrics, is that they can be reductive. High link counts and pumped-up Google juice do not guarantee success, more traffic, or business success. For example, we might determine our competitor has X links from sites A, B and C, so we should do likewise. If we do likewise, plus a little more, then we win.

But often we don’t.

We often don’t win because there are multiple factors in play. Our competitor’s site might rank for reasons that are difficult to determine, and even more difficult to emulate. They may have brand, engagement metrics or historical advantages. But most challenging of all, they could have some underlying competitive advantage that no amount of link building or ranking for keyword X by a new site will counter. They may just have a better offer.

Winning The Search War Against Your Competitors

There’s an old joke about a two guys out walking in the African Savannah. They come across a hungry lion. The lion eyes them up, then charges them. One man turns and runs. The other man yells at him “you fool, you can’t outrun a lion!” The other man yells back “that’s true, but I don’t have to outrun the lion. I only have to outrun you!”

Once we figure out what Google wants, we then need to outrun other sites in our niche in order to win. Those sites have to deal with Google’s whims, just like we do.

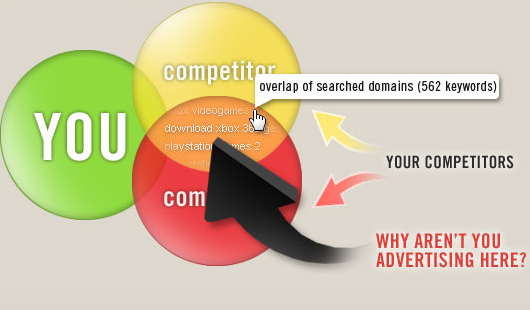

Typically, webmasters will reverse engineer competitor sites, using web metrics as scores to target and beat. Who is linking to this page? How old are the links? What are their most popular keywords? Where are they getting traffic from? That’s part of the puzzle. However, we also need to evaluate non-technical factors that may be underpinning their business.

Competitive Analysis

Competitive intelligence is an ongoing, systematic analysis of our competitors.

The goal of a competitor analysis is to develop a profile of the nature of strategy changes each competitor might make, each competitor's possible response to the range of likely strategic moves other firms could make, and each competitor's likely reaction to industry changes and environmental shifts that might take place. Competitive intelligence should have a single-minded objective -- to develop the strategies and tactics necessary to transfer market share profitably and consistently from specific competitors to the company. We should look at the sites positioned around and above us and analyse what they do in terms of business.

Do they understand the target market a little better than we do? Are their goals different from ours? If so, how are they different, and why? How are they pricing their products and services? How do their services differ from our own? In other words, do they know something we don’t?

We can optimize for competitive advantage. It's about identifying what market your competitors capture, and where that market is heading in the future. Once you've figured that out, you might be able to discover opportunities your competitors have missed.

How To Undertake Competitive Analysis

It would be great if we could call up our competitors and ask them exactly what they're doing, how they’re doing it, and where they are heading - and they’d tell us. But we all know that's not going to happen.

So we have to dig. We don't want to do too much digging, as it is time consuming, expensive and, truth be told, somewhat tedious. Thankfully, a lot of the answers we need are sitting right in front of us and readily available.

To undertake a competitive analysis, try asking these questions:

- What is the nature of competition?

- Where does the competitor compete?

- Who does the competitor compete against?

- How does the competitor compete?

1. The Nature Of The Competition

The little guy used to prosper in search just by being clever. If you knew the tricks, and the big companies didn’t - and typically, they didn’t - you could beat them easily. This is now harder to do. These days, traditional power structures play a greater role in search results, so it is often the case that big brands can dominate SERPs by virtue of their offline market position. Their market position is creating the signals Google tends to look for, such as regular major press mentions, resulting links and direct search volume, often with little direct SEO effort on the part of the brand.

So, if you’re the little guy coming up against big, entrenched competition, that’s going to be a hard road.

We saw what happened with Adwords, and now the same thing is happening in the main search results. Those with the deepest pockets could run Adwords campaigns that appear to make absolutely no fiscal sense, either because they’re getting their revenue from elsewhere to subsidise the Adwords spend, or, as is often the case, they’re prepared to wage a defensive war of attrition to prevent new competitors entering or dominating their space.

I think these long-term trends are mostly due to increasing competition. As more and more companies bid on Adwords for a finite number of clicks, it inevitably drives up the cost of clicks (simple supply and demand). It also doesn’t help that a lot of Adwords users are not actively managing their campaigns or measuring their ROI, and are consequently bidding at unprofitably high levels. Google also does its best to drive up CPC values in various ways (suggesting ridiculously high default bids, goading you to bid more to get on page 1, not showing your ad at all if you bid too low – even if no other ads appear etc).

Of course, this is just my data for one product in one small market. But the law of shitty clickthrus predicts that all advertising mediums become less and less profitable over time. So I would be surprised if it isn’t a general trend

In the main search results, a large companies position will be influenced by spend they make elsewhere. Big PR media campaigns, and the resulting press, links, and mentions in other channels, all result in a big data footprint of attention and interest that Google is unlikely to miss.

However, the little guy still has one advantage that the big businesses seldom have. The little guy is like the speedboat compared to an ocean liner. They may be small, they may be easily swamped in a storm, but they can change direction very quickly. The ocean liner takes a long time to turn around.

The little guy can change direction and get into new markets quickly - “pivot” in Silicon Valley parlance. The little guy can twist new markets slightly and invent entire new markets, whilst the bigger business tend to sail pre-set courses along known routes. This is how the once nimble Google trounced their search competitors. They didn’t take the competitors head on, they took a different tack (focused on the user, not advertisers), made strategic alignments (Yahoo), a few twists and turns (Overture) , and eventually worked themselves in the center of the search market. Had they just built another Yahoo, they wouldn’t have got very far.

If you’re a small business or new to a market, then it’s not a great idea to take on a big, entrenched business directly. Rather, look for ways you can outmanoeuvre them. Are there changes in the market they aren’t responding to? Are the markets about to change due to innovations coming over the horizon that you can spot, but they can’t? Look for areas of abrupt change. The little guy is typically well placed to take advantage of rapid change in markets. And new, fast developing markets.

Choose your market space carefully.

So, how do you become the next Picasso? The same way you build a powerful brand. Create a new category you can be first in.

...

The best way to become a world-famous artist is to create paintings that are recognized as a new category of art. - Al Ries

2. Where Does The Competitor Compete?

For example, are they limited to a certain geography? Culture? Language? Do they have an offline presence?

You could take their business model to a geographic location they don’t serve. Is there something that succeeds in the US, but has yet to reach Australia? Or Europe? Are your competitors targeting nationally, when you could target locally?

3. Who Do You Compete Against?

Make a list of the top ten competitors in a niche. Compare and contrast their approaches and offerings. Compare their use of language and their relative place in the market. Who is entrenched? Who is up-and-coming?

The up-and-coming sites are interesting. If they’re new, but making headway, it pays to ask why that’s happening. Is it just because they’re getting more links, or is it because they’re doing something new that the market likes? Bit of both?

I think the most interesting opportunities in search are found by watching the sites that aren't doing much in the way of SEO, but they are rising fast. If they’re not playing hard at “rigging the search vote” in their favour, then their positioning is likely due to genuine interest out in the market.

4. How Does The Competitor Compete

What are the specifics of the products and services they are offering. Lower prices? High service levels? Do they provide information that can't be obtained elsewhere? Do they have longevity? Money, staff and resources? Are they building brand? What are they doing besides search?

What prevents you doing likewise?

5. Are They More Engaging?

Google talk about engagement a lot, and we saw engagement metrics become important after updates Penquin/Panda.

Panda is really the public face of a much deeper switch towards user engagement. While the Panda score is sitewide the engagement "penalty" or weighting effect on also occurs at the individual page. The pages or content areas that were hurt less by Panda seem to be the ones that were not also being hurt by the engagement issue.

Engagement is a measure of how interesting visitors find a site. Do people search for your competitors by name, do they click through rather than back to the SERPs, and do they talk about that site to others?

The click-back, or lack-thereof, is a hard one to spot if you don’t have access to a websites data. Take a look at your competitors usability. Is it easy to navigate? It is obvious where visitors need to click? Are they easy to order from? Is their offer clear? Do they have fast site response times? Of course, we view these things as fundamental, however many sites still overlook the basics. If you can optimize in these areas, do so. If your competitors ranking above you have good engagement design and content, then you need to do it, too.

One baseline to look at is branded search volumes. If people are specifically & repeatedly looking for something that typically means they are satisfied with it.

Matt Cutts has recently mentioned that incumbent sites may not enjoy the previous “aged” advantages they’ve had in the past.

This may well be the next big Google shift. It makes sense that Google would reward sites that have higher user utility scores, all other factors being equal. Older sites may have built up a lot of links and positive SEO signals over time, but if their information is outdated and their site cumbersome, the site will likely have low utility. Given the rise of social media, which is all about immediacy and relevance (high utility as perceived by the user), Google would be foolish to reward incumbency at the expense of utility. It’s an area we’re watching closely as it may swing back some advantage to the smaller, nimble players.

6. Do They Have A Good Defensive Position?

Is it hard to enter their market? Competitors may have a lot of revenue to throw around, and a considerable historical advantages. Taking on the likes of Trip Advisor would be difficult and expensive, no matter how good the SEO.

If they have a strong defensible position, and you have limited resources, trying creating your own, unique space. For example, in SEO, you could compete with other SEOs for clients (crowded), or your could become a local trainer who trains existing SEOs inhouse (less crowded). You could move from selling widgets to hiring out widgets to people. You could repackage your widgets with other widgets to create a new product. An example might be selling individual kitchen utensils, but packaged together, they become a picnic kit.

Look for ways to create slightly different markets that you can make your own.

7. What’s In Their Marketing?

What does their advertising look like? Scanning competitor's ads can reveal much about what that competitor believes about marketing and their target market.

Are they changing their message? Offering new products? Rebranding? Positioning differently? This is not absolute, of course, but it could offer up some valuable clues. There’s even a Society of Competitive Intelligence Professionals devoted to this very task.

Big Topic

Whilst competitive analysis is huge topic, the value of even a basic competitive analysis can be considerable.

By doing so, we can adjust our own offering to compete better, or decide that competing directly is not a great idea, and that we would be better off entering a closely-related market, instead . We may create a whole new niche and have no competition. At least, not for a while. We might make a list of all the things we need to do to match and overtake a fast rising new challenger who isn’t doing much in the way of SEO.

There's much more to search competition that algo watching, keywords and links. And many ways to compete and optimize.