What is Killing AOL & Yahoo!?

The Big Portals Can't Grow Ad Revenues

In spite of the transitioning of print Dollars to digital dimes for print media, TV advertising remains healthy and robust. Much like the decline of print media, the flow of brand ad Dollars online is skipping over even some of the largest players, leaving them out of the growth from the shift to online media.

While Yahoo! is still a leader in many categories they are struggling to sell their ad inventory directly & are selling more of it as backfill/remnant inventory. This issue has also hit AOL pretty hard. In spite of acquiring Huffington Post & being willing to sell ads at a bogus $1000 CPM, they are still losing money and their ad revenues were only up marginally.

The Stock Market Values Big Portals at Next to Nothing

Some of the bigger portals are hoping that TV-styled web ratings will lift their ad sales, but I am skeptical & so is the market. AOL's stock was down about 50% over the past month before the recent rally (and half of what was left was cash on the books). Part of AOL's recent stock price recovery is from them announcing a stock buy back. Yahoo! is basically valued at $0 when you back out their cash on hand & investments in foreign assets.

Why Can't the Portals Grow?

Part of the lack of growth in ad budgets for the large portals comes down to hype around mobile (which is now ~ 12% of search ad clicks), Facebook & social media. The brand ad Dollars that are being spent to "look cool" are riding the new fads & trends.

Riding the social hype, now even AdWords ads have a social element to them.

Three other big issues that are impacting the portals (discussed further below) are ad retargeting, custom integrated media buys, and the mixing of traffic quality.

As a baseline to consider how significantly these trends are impacting the big portals are, consider that...

- Demand Media's eHow was hit by Panda

- eHow removed 300,000 pages

... yet their quarterly traffic was roughly flat compared to Q1 & revenue was up 32% year over year. In spite of having a search-first distribution strategy, getting hammered by Panda, and removing tons of content, Demand Media is still growing far faster than AOL or Yahoo! are. Thus it is no wonder that Yahoo! & AOL are not highly valued by the investment community.

1. Ad Retargeting

Between contextual ad targeting & ad retargeting advertisers have many options to reach their audience without paying premium ad inventory rates to show up where they are less relevant.

At first I thought ad retargeting would lift CPMs as another ad channel to compete for inventory. For smaller sites about knitting or celebrity gossip it probably does, but for "premium" media that is way overpriced, it does the opposite. At first this hit some of the sorta b-list sites but not the big portals, then over time that trend grew and it eventually even consumed the big portals.

Google took ad retargeting mainstream. At first advertisers bid artificially high for this traffic, based on its perceived value, but since these advertisers were largely only competing/bidding against themselves & these ads can appear anywhere, many have now figured out that they can significantly cut their bids & still get plenty of exposure.

Some ecommerce websites not only do ad retargeting to people who visited their website, but some go so far as to target the individual products you looked at or put in your cart. You may not notice the trend if you are shopping for things you purchase (as a reflection of our identity we generally tend to perceive the things we like as being normal & as being more widely popular than they are), but if you shop for something out of the blue then the ads that follow you are far more noticeable.

Sometimes I buy a gag gift to give away before the real gift so as to sorta mis-set expectations & see a range of responses. :)

When I was buying a 4th anniversary gift for my wife, while shopping online I joked with a friend about how ugly & over-the-top some of the Zales items were. Those items then started to follow me around the web in banner ads!

What is more valuable than seeing a person putting an item in a shopping cart is seeing the actual items a person has already purchased. Amazon suggests related products on their web pages, sends personalized "you might like" email recommendations, and is leveraging their data to build a distributed ad network:

Amazon will now use its huge supply of data to pool consumers into buckets based on the products they looked at or purchased on the retailer's website. The company will help advertisers reach these consumers with targeted media, using behaviorally targeted display ads to drive them to

any URL.

There are many other technologies & business models built off of retargeting: some businesses try to rent a pixel on 3rd party websites, some analytics services respawn cookies, Akamai's CDN offers pixel-free tracking, Facebook's like button collects data even if you do not click on it, and 3rd party social media "add to" buttons collect & sell similar data.

The shift to mobile will only further improve ad retargeting. Digital receipts are becoming more popular and Eric Schmidt wants to be in your pants.

2. Integrated Media Buys

WebMD

WebMD has sponsored sections where you go from information to self-quiz right into integrated custom ad channels tied directly to the disease.

Blog Sponsorship

Pay Per Post sort of took the low road in their marketing approach with getting exposure on blogs. ReviewMe (which I co-founded & sold my share in many years ago) intended to take a somewhat higher road, but perhaps didn't attract as much brand attention as we had hoped for, at least not initially.

More recently many of the online blogging communities have become custom ad networks. Want to reach moms? P&G did a deal with BlogHer & it was popular enough that there are blog posts and videos about it.

YouTube

Shortly after watching a Youtube video about sugar and insulin I soon saw the following YouTube experience, with an ad over a video & another related ad unit off to the right

Taking the "be the content rather than the ad unit" one step further, YouTube has done custom ads for Nintendo, where the entire Youtube website interface reflected the game.

Tipp-Ex also had a popular viral YouTube ad.

Google's Nikesh Arora gave a speech where he mentioned that WillItBlend blends in product placements for $5,000.

3. Watering Down of Network Quality

Some of the ad networks backfill with scam "inventory" (like Yahoo! Search or Looksmart were famous for doing with "search" ads).

That mixing in of slop traffic only further drives down network pricing, but that only becomes such a big issue because of the other above changes. Part of why the fraudulent "inventory" on ad "networks" is appealing is that there is likely a far higher markup by the ad agency than there is when buying premium ad inventory.

"We just got u 34 trillion ad impressions...and these are 1/5th the cost of the other ones" sounds efficient & appealing. They can mystery meat up the margin a lot higher on the junk than they can on the premium & they can mix in enough ad retargeting into the aggregate buy so you don't know where the performance came from, but it looks ok in aggregate (so long as you don't look any deeper).

This is no different than email co-registration & incentivized leads being mixed in with quality SEO & PPC driven leads. Backfill with junk to increase volume, but mix in enough of the good stuff to keep the aggregate performance high enough to still make it worth doing, all the while arbitraging the value of existing brand strength & the additional yield from retargeting.

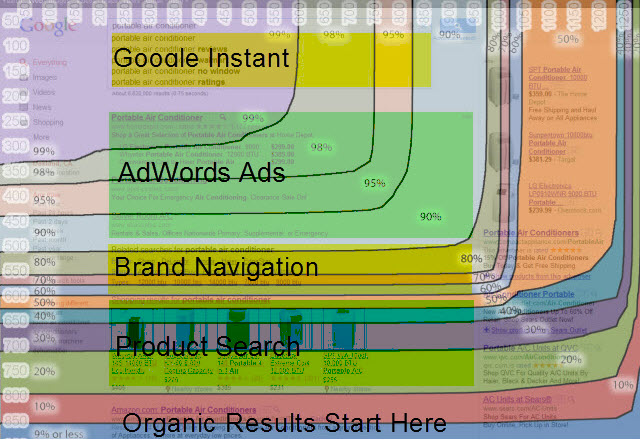

4. Search Engines as Stealth Web Portals

Want local? Use Google Places. Want video? Watch Google's YouTube. Looking to buy something? See the item listings in the search results. Need a stock quote? Its right in the search results.

A lot of the general purpose generic traffic that helped subsidize the large portals is now being ate by search engines like Google & Bing that are putting more data directly into the search results. This trend is even more significant than it appears on the surface when you consider investments in 3rd party companies that are arbitraging the search results (like Whaleshark Media), the inclusion of custom ad formats & lead generation funnels in the search results, and tests of vertical refinements currently being built out (in travel, deals, games and social networks like Google+).

5. The Next Big Issue? Author Identity & Retaining Talent

Services like Klout aim to create a currency out of a person's influence, which helps advertisers figure out who they should pitch.

Google's weighting on domain authority to some degree locks authors into their current jobs by making it hard for a new site to build up the initial momentum needed to become profitable. Google has implemented rel=author as a way to experiment with creating an author ranking system. If they are successful with it (and share author ratings publicly) that will give the most successful individual authors more leverage over the networks they write for, which in turn would only further weaken the big broad portals by making it easier for authors to jump ship and do their own thing.

As online advertising technology continues to advance, on the next leg down a lot of the of the big media companies will see talent flea. They saw what was coming, but couldn't change.

"They [AOL] absolutely have some core assets, but I think you would have a hard time finding someone who would describe them as a 'must buy,'" says Craig Atkinson, chief digital officer at PHD, the media-buying unit owned by Omnicom Group Inc. - source

Comments

Hey Aaron:

Great post today! I really enjoyed it.

Quick question for you-- you said "There are many other technologies & business models built off of retargeting: some businesses try to rent a pixel on 3rd party websites…."

Can you tell me the names of the businesses that place the pixels on 3rd party websites? I'd like to learn more about them.

Thanks!

-KT

Carol Bartz out as Yahoo! CEO & AOL's Tim Armstrong may be next.

This WSJ article highlights many of my above points, as well as the drop in CPM rates over the past year:

This WSJ article highlights how Yahoo! has lost leverage on advertisers, going from a company of "no" to a company of "yes" to advertiser requests

Add new comment